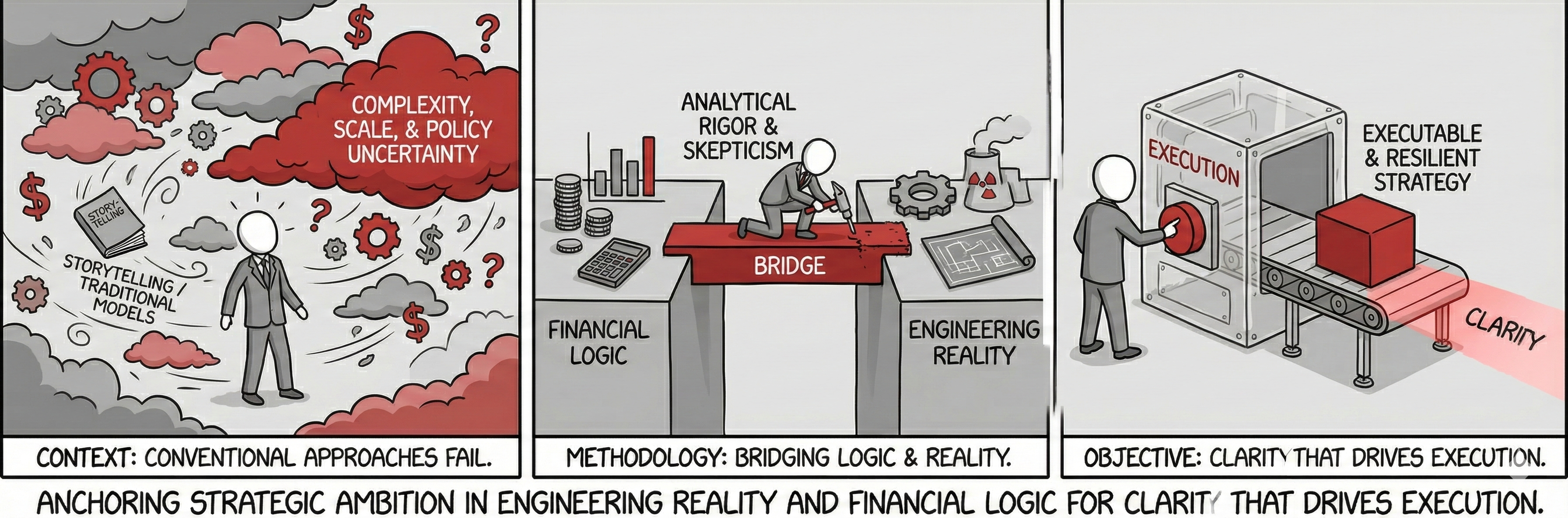

The Mandate: Strategy Rooted in Industrial Reality

Proccium advises clients in the resource, energy, and circular-economy sectors on high-stakes strategic and investment decisions. Our focus is on contexts where complexity, capital scale, and policy uncertainty resist conventional approaches.

We bridge financial logic and engineering reality to design strategies that are not merely aspirational but executable and demonstrably resilient. Our methodology replaces storytelling with analytical rigor and disciplined skepticism.

The objective is not presentation, but Clarity that Drives Execution.

Why Clients Engage Proccium

We partner with leaders who prioritize substance, evidence, and measurable outcomes.

Why Clients Engage Proccium

| Dimension | Our Commitment | Institutional Value | |

|---|---|---|---|

| Analytical Rigor | Investment decisions built on quantified scenarios and auditable models. | Strategies and valuations that withstand scrutiny from boards, banks, and regulators. |

| Industrial Realism | Deep experience in project development, process industries, and technology deployment. | Translating strategic intent into simple, robust project architectures. |

| Execution Focus | Strategies designed as engineered decision frameworks—structured, measurable, and adaptive. | Reducing optimism bias and eliminating common failure modes of large-scale projects. |

| Principled Discretion | Engagement reflects personal commitment, professional obligation, and integrity. | Confidentiality and neutral, technically grounded review of assumptions and risk. |

Forms of Engagement: How Clients Work with Proccium

Proccium engagements are structured to convert complexity into decision-ready insight. Formats mirror the discipline of leading strategy firms while remaining firmly anchored in industrial and financial reality.

Each format below is designed as a modular building block. In practice, engagements combine several of these elements into a coherent, end-to-end support model.

Strategic Diagnostic & Reality Check

Rapid assessment of narratives, numbers, and risk posture.

View Details

Strategic Diagnostic & Reality Check

Rapid assessment of narratives, numbers, and risk posture.

View DetailsDesigned as a focused, time-boxed engagement to establish a fact-based baseline and challenge core assumptions.

The Objective: An Unvarnished Baseline

We do not simply review your slide deck; we interrogate the fundamental logic of the business case. This offering provides Boards, Investors, and Senior Management with an independent "circuit breaker" to answer three critical questions:

- Is the Narrative Coherent? Does the strategic rationale hold up against market realities and competitive dynamics?

- Are the Numbers Defensible? Do unit economics obey the laws of physics and supply chain constraints?

- What are the Fatal Flaws? If this project fails, why will it happen?

Our Methodology: The "Red Team" Approach

We utilize a rapid (typically 2-4 weeks) approach separating analysis into three parallel workstreams:

- Narrative Stress-Testing: Deconstructing the investment thesis to find "magic asterisks".

- Technical & Economic Sanity Check: Validating that the financial model reflects engineering reality.

- The Pre-Mortem Analysis: Inverting the risk analysis to expose non-linear risks.

Industrial Strategy Architecture

Capital allocation, portfolio logic, and flexibility by design.

View Details

Industrial Strategy Architecture

Capital allocation, portfolio logic, and flexibility by design.

View DetailsDefines the structural logic for where and how to deploy capital under uncertainty, moving beyond static plans to dynamic, option-based architectures.

The Challenge: Escaping the Deterministic Trap

Traditional industrial strategy often relies on "point forecasts"—single-line predictions of commodity prices or policy outcomes. In volatile markets, this is a recipe for stranded assets. We view strategy not as a linear path, but as an architecture of choices that must remain robust across multiple future scenarios.

Our Methodology: Strategy as a Portfolio of Options

We apply rigorous portfolio logic to industrial assets, ensuring that capital allocation maximizes flexibility and minimizes the cost of irreversibility:

- Portfolio Correlation Analysis: Identifying hidden dependencies. (e.g., ensuring your "diversified" projects aren't all exposed to the same specific regulatory or energy-price risk).

- Flexibility by Design: Embedding "Real Options" into the industrial footprint—designing assets that can switch inputs, pause production, or expand modularly in response to market signals.

- Sequencing & Gating: Defining strict capital gates. We determine what money must be spent now to preserve option value, versus what should be deferred until uncertainty resolves.

Deliverables

We provide the framework for disciplined execution:

- The Strategic Atlas: A visual map of the portfolio showing value, risk, and strategic fit across scenarios.

- Capital Allocation Ruleset: A prioritized logic for rationing capital when constraints bind.

- Dynamic Implementation Roadmap: An execution plan with defined "trigger points" for pivoting strategy based on external market data.

Financial & Valuation Modeling

Audit-ready models with full referential integrity.

View Details

Financial & Valuation Modeling

Audit-ready models with full referential integrity.

View DetailsConstruction or reconstruction of transparent, traceable financial models for projects, assets, and portfolios, strictly aligned with institutional standards (FAST) and lender requirements.

The Standard: Radical Transparency

A financial model is not just a calculator; it is a communication tool for lenders and investors. Too often, models degrade into "black boxes"—tangles of hard-coded numbers and circular logic that collapse under scrutiny. We build models designed to be audited.

Our Architecture: Structural Rigor

We adhere to strict modular design principles that separate Inputs, Calculations, and Outputs, ensuring that every result can be traced back to its source assumption without forensic accounting.

- Referential Integrity: No "floating numbers." Every input is cataloged; every calculation is linked. We eliminate the risk of version-control errors destroying value.

- Dynamic Time-Dimensioning: Models that handle the complexities of industrial timelines—construction delays, ramp-up curves, and varying maintenance cycles—without breaking structural logic.

- Lender-Ready Output: Automated generation of Debt Service Coverage Ratio (DSCR), Loan Life Coverage Ratio (LLCR), and covenant testing sheets that financing partners expect.

Deliverables

We deliver assets that accelerate the due diligence process:

- The Master Model: A fully open, unlocked, and documented Excel environment.

- The Databook: A comprehensive sourcing document linking model inputs to engineering studies, offtake agreements, and vendor quotes.

- User Guide & Logic Map: Documentation ensuring your internal team can operate and update the model long after our engagement ends.

Stochastic & Real Options Modeling

Quantifying flexibility under multi-dimensional uncertainty.

View Details

Stochastic & Real Options Modeling

Quantifying flexibility under multi-dimensional uncertainty.

View DetailsDesign of uncertainty structures, correlated stochastic drivers, and Monte Carlo engines to expose the true risk-return profile hidden by static averages.

The Challenge: The Flaw of Averages

In volatile industries like energy and metals, "average" conditions rarely occur. Traditional static models (using P50 inputs) fail to capture the impact of extreme volatility and often drastically underestimate risk. We replace single-point guesses with rigorous probability distributions.

Our Methodology: Valuing Flexibility

We go beyond standard risk assessment to quantify Real Options—the value of managerial flexibility to alter the course of a project in response to market changes. We mathematically model the value of:

- The Option to Defer: Quantifying the value of waiting for regulatory or market clarity before committing capital.

- The Option to Switch: valuing dual-fuel capabilities or flexible process routes that allow arbitrage between input markets.

- The Option to Abandon: Structuring "off-ramps" that limit downside exposure if the investment thesis breaks.

Deliverables

We provide sophisticated, decision-useful analytics:

- Probabilistic S-Curves: Visualizing the full range of potential outcomes (P10, P50, P90) rather than a single misleading IRR number.

- Correlation Matrices: Modeling how drivers (e.g., gas prices, carbon tax, FX rates) move together, preventing the "perfect storm" from being a surprise.

- Value of Information Analysis: Calculating exactly how much it is worth to pay for better data or a pilot plant before the final investment decision.

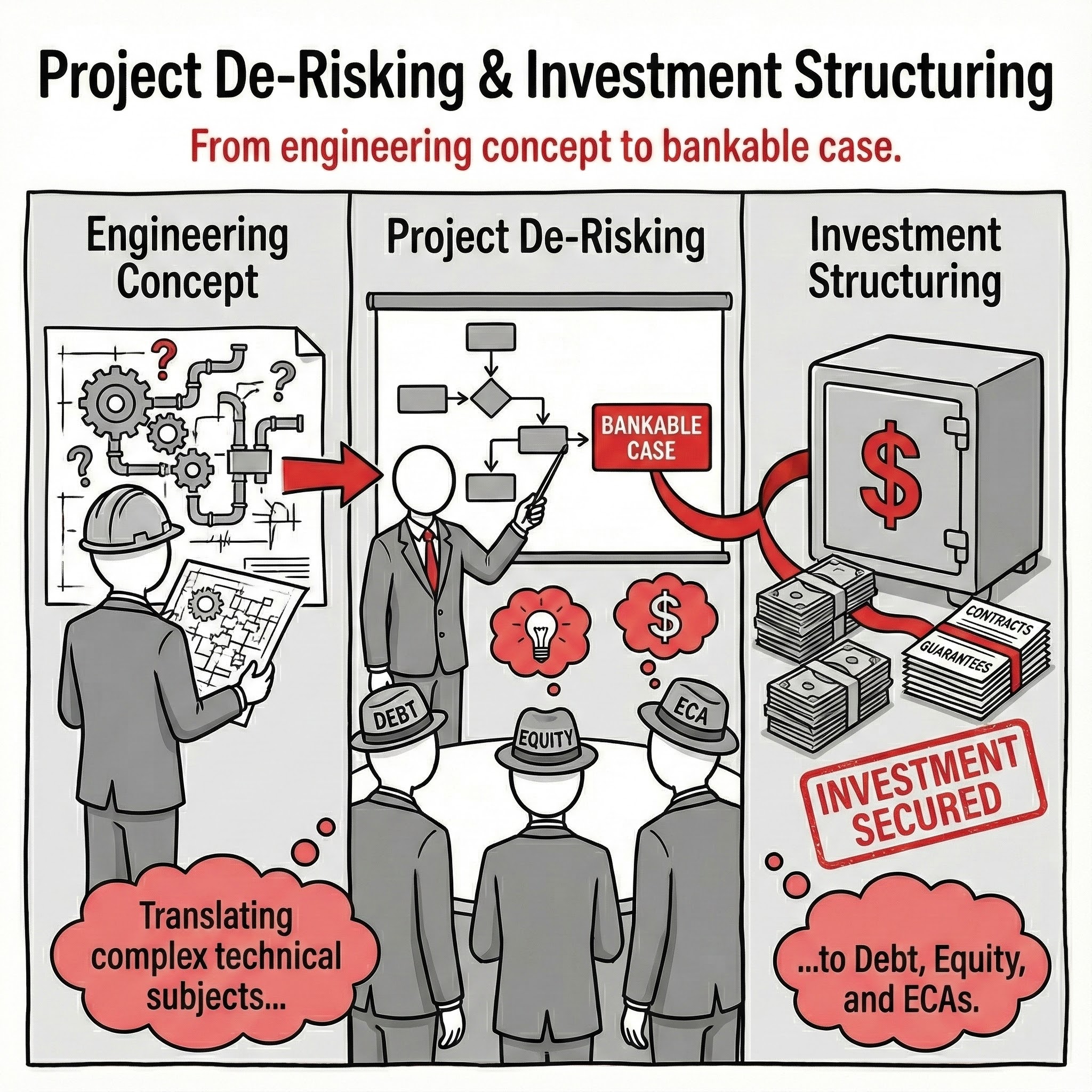

Project De-Risking & Investment Structuring

From engineering concept to bankable case.

View Details

Project De-Risking & Investment Structuring

From engineering concept to bankable case.

View DetailsIntegrated review of flowsheets, CAPEX/OPEX, ramp-up, and implementation risk to shape robust, financeable project architectures.

The Challenge: The Language Barrier

Projects often fail to reach Financial Close not because the technology is flawed, but because the risk profile is unintelligible to capital providers. Engineers speak in mass balances and yield curves; financiers speak in covenants and coverage ratios. A disconnect here results in a prohibitive cost of capital or a rejected credit application.

Our Methodology: The Technical-Financial Bridge

We translate complex technical and project development realities into a language understood by Debt Providers, Equity Investors, and Export Credit Agencies (ECAs). We re-engineer the project structure to align with the risk appetite of specific capital pools:

- Contractual Risk Allocation: Optimizing the interface between EPC, O&M, and Offtake agreements to ensure risks are borne by the parties best able to manage them—a prerequisite for non-recourse finance.

- Technology Bankability: De-risking novel process technologies through performance guarantees, contingency sizing, and pilot-scale validation strategies that satisfy independent engineers.

- Market & Revenue Structuring: Designing offtake structures (e.g., floor prices, take-or-pay) that secure the debt service line without sacrificing all upside potential.

Deliverables

We provide the documentation required to pass credit committee scrutiny:

- Bankability Pre-Feasibility Study: An early-stage audit identifying "red flags" that would block future financing.

- The Information Memorandum (Technical Chapter): Authoritative narratives describing the asset's technical robustness for lenders.

- Term Sheet Negotiation Support: Technical-commercial advisory during the negotiation of financing terms and covenants.

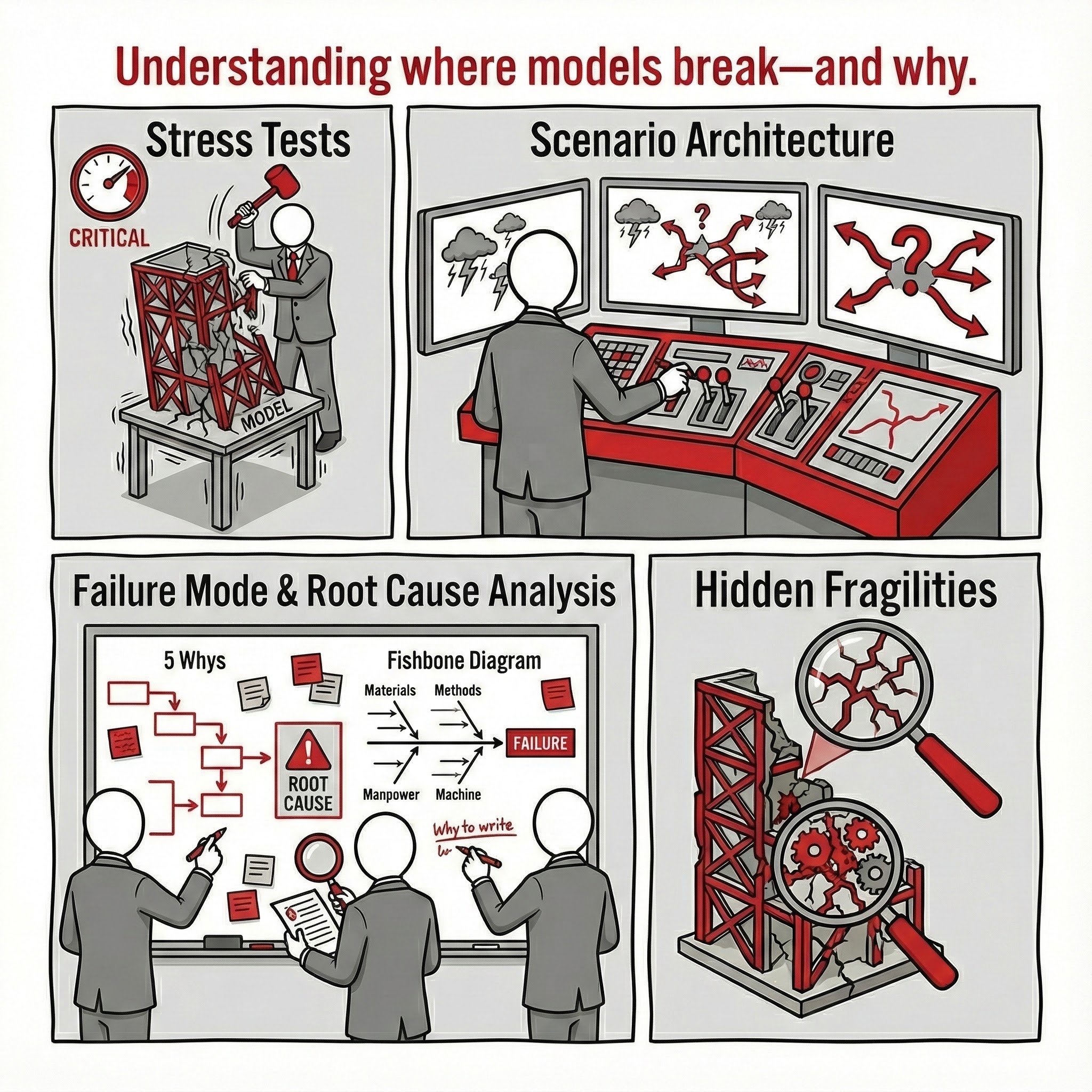

Model Stress Testing & Scenario Architecture

Understanding where models break—and why.

View Details

Model Stress Testing & Scenario Architecture

Understanding where models break—and why.

View DetailsSystematic stress tests, tail-risk exploration, and entropy-aware scenario design to expose non-linearities and hidden fragilities that standard sensitivity tables miss.

The Challenge: The Trap of Linear Thinking

Standard sensitivity analysis (e.g., +/- 10% on CAPEX) offers a false sense of security. It fails to capture "cliff edges" where a combination of small changes triggers a catastrophic failure in debt service or liquidity. Real-world risks are rarely linear; they are compounded.

Our Methodology: Breaking the Model to Save the Project

We treat the financial model as a structural engineer treats a bridge: we load it until it collapses to understand its ultimate limits. We identify exactly how much stress the project can absorb before equity is wiped out or covenants are breached.

- Reverse Stress Testing: Instead of asking "What happens if prices drop?", we ask "At exactly what price does the project default?" and work backward to assess the probability of that event.

- Entropy-Aware Scenarios: Designing scenarios that account for system degradation—the tendency for operational efficiency to drift and costs to creep over time, rather than assuming "steady state" perfection.

- Multivariate Shock Analysis: Testing the correlation between risks (e.g., when inflation spikes, interest rates rise and demand often softens) to expose the "perfect storm" vulnerability.

Deliverables

We provide actionable intelligence on the project's structural integrity:

- The Breakpoint Report: A definitive list of the precise variables that break the investment case.

- Liquidity Stress Maps: Visualizing cash flow pinch-points during the critical ramp-up phase.

- Covenant Headroom Analysis: Quantifying the safety margin against lender requirements under distressed scenarios.

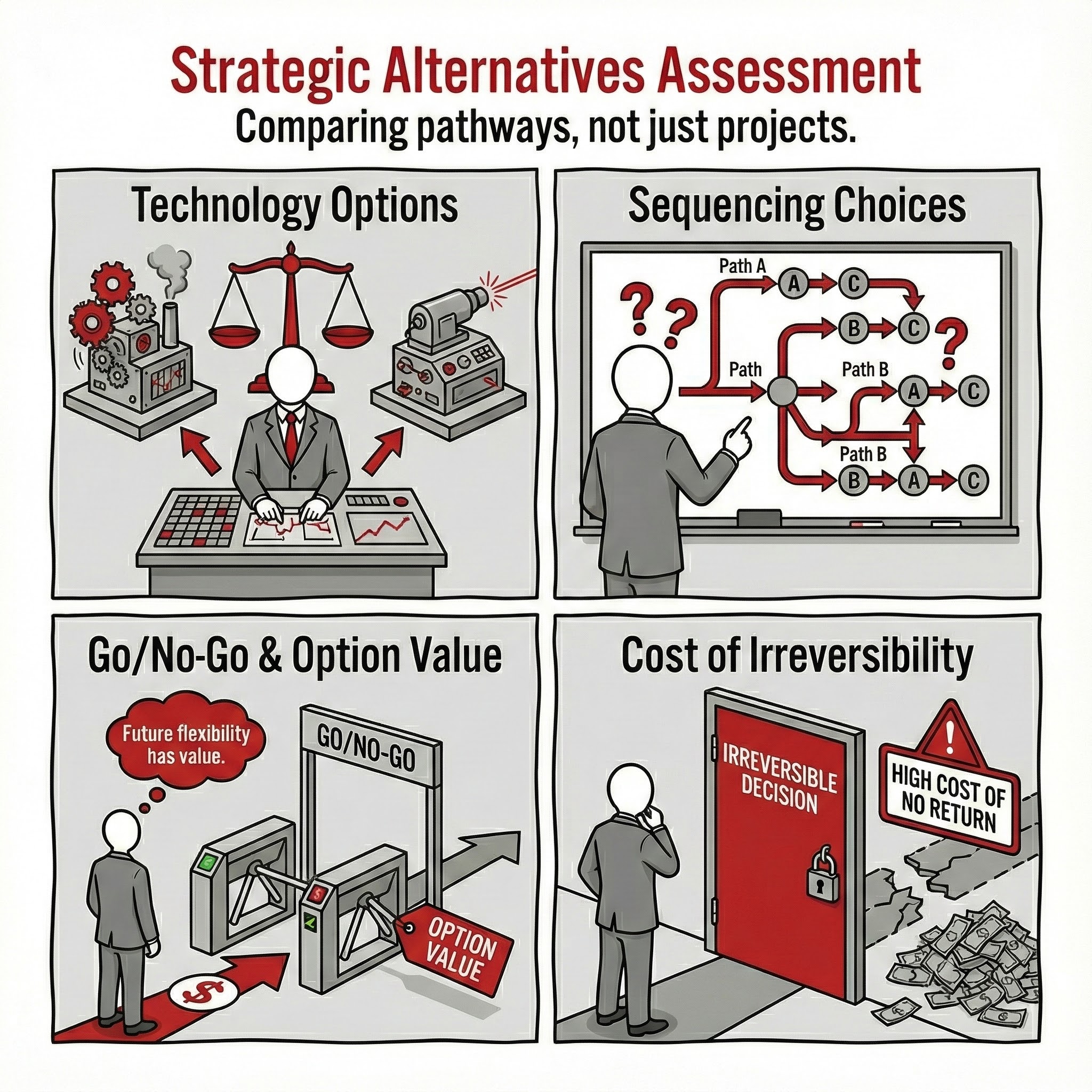

Strategic Alternatives Assessment

Comparing pathways, not just projects.

View Details

Strategic Alternatives Assessment

Comparing pathways, not just projects.

View DetailsComparative assessment of technology options, sequencing choices, and go/no-go decisions, explicitly calculating the option value and the high cost of irreversibility.

The Challenge: False Binaries & Tunnel Vision

Strategic errors often stem from framing decisions too narrowly: "Should we build this plant or not?" This ignores the broader universe of alternatives—different technologies, different scales, or different sequences of deployment. We prevent the "sunk cost fallacy" from driving bad capital allocation.

Our Methodology: Evaluating the Cost of Irreversibility

We do not just compare Net Present Value (NPV); we compare the structural characteristics of different strategic paths. We help clients understand the "penalty" for making a decision that cannot be undone.

- Pathway Comparison: Analyzing full strategic trajectories (e.g., "Modular Build-out vs. Mega-Project"). A modular approach may have higher unit costs but superior value because it retains the option to stop if the market turns.

- Technology Agnosticism: An unbiased trade-off analysis of competing technologies (e.g., Hydrogen vs. Electrification) based on maturity, CAPEX efficiency, and operational risk—uncolored by vendor hype.

- Regret Minimization: Utilizing "Minimax Regret" frameworks to identify the strategy that performs "least badly" across the widest range of negative future scenarios.

Deliverables

We deliver the decision support tools necessary for high-stakes selection:

- The Strategic Trade-Off Matrix: A rigorous scoring of alternatives against weighted strategic criteria (Financial, Technical, Permit, Market).

- Decision Trees & Sequencing Maps: Visualizing the optimal order of operations to maximize information gain before capital commitment.

- The "Do Nothing" Valuation: A properly calculated baseline of the status quo to ensure the proposed investment actually destroys less value than standing still.

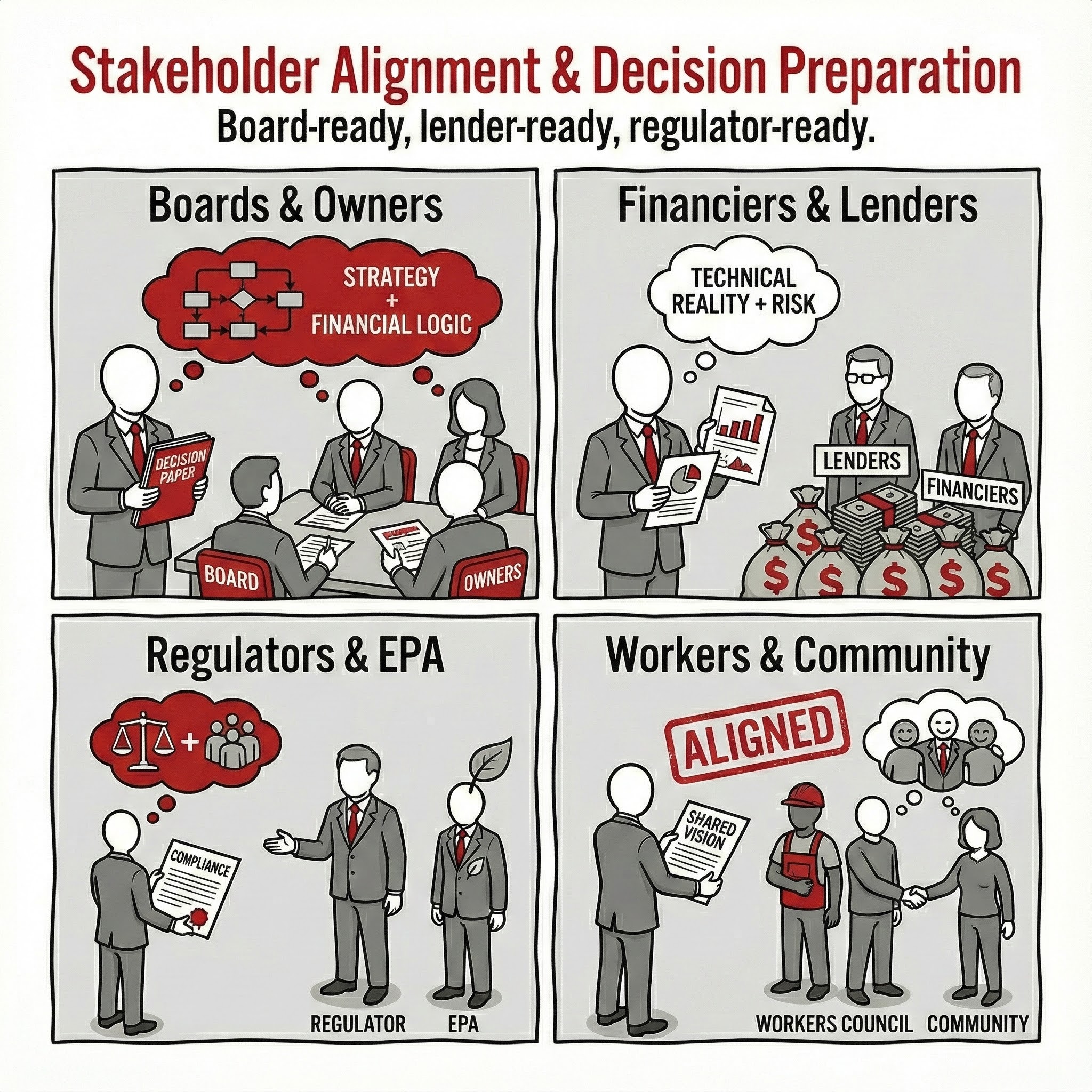

Stakeholder Alignment & Decision Preparation

Board-ready, lender-ready, regulator-ready.

View Details

Stakeholder Alignment & Decision Preparation

Board-ready, lender-ready, regulator-ready.

View DetailsPreparation of decision papers and data-driven narratives that align strategy, technical reality, and financial logic for boards, financiers, regulators, workers councils, and communities.

The Challenge: The Tower of Babel

Large industrial projects often stall not because the engineering is wrong, but because stakeholders are talking past each other. A Board’s definition of "risk" (capital loss) differs from a Regulator’s (compliance failure), which differs from a Workers Council’s (job security) or a Community’s (environmental safety). We solve the fragmentation that leads to decision paralysis.

Our Methodology: One Truth, Many Dialects

We act as the translation layer. We establish a single, fact-based technical and financial reality, then articulate that reality to address the specific anxieties and incentives of each group:

- Boards & Owners: Focusing on fiduciary duty, capital efficiency, and strategic fit—stripping away engineering jargon to present clear risk/return trade-offs.

- Financiers & ECAs: Translating project metrics into "bankable" language—coverage ratios, downside protection, and enforceability of contracts.

- Regulators, Workers Councils & Communities: Converting abstract corporate strategy into concrete commitments regarding safety, local employment, environmental stewardship, and long-term operational stability.

Deliverables

We provide the communication architecture for consensus:

- The Integrated Investment Memorandum: The definitive "single source of truth" document for the project.

- Stakeholder-Specific Briefing Packs: Tailored presentations that address the specific KPI requirements of lenders vs. unions vs. environmental agencies.

- Q&A Defense Preparation: rigorous "murder board" sessions to prepare management for the toughest questions from hostile or skeptical stakeholders.

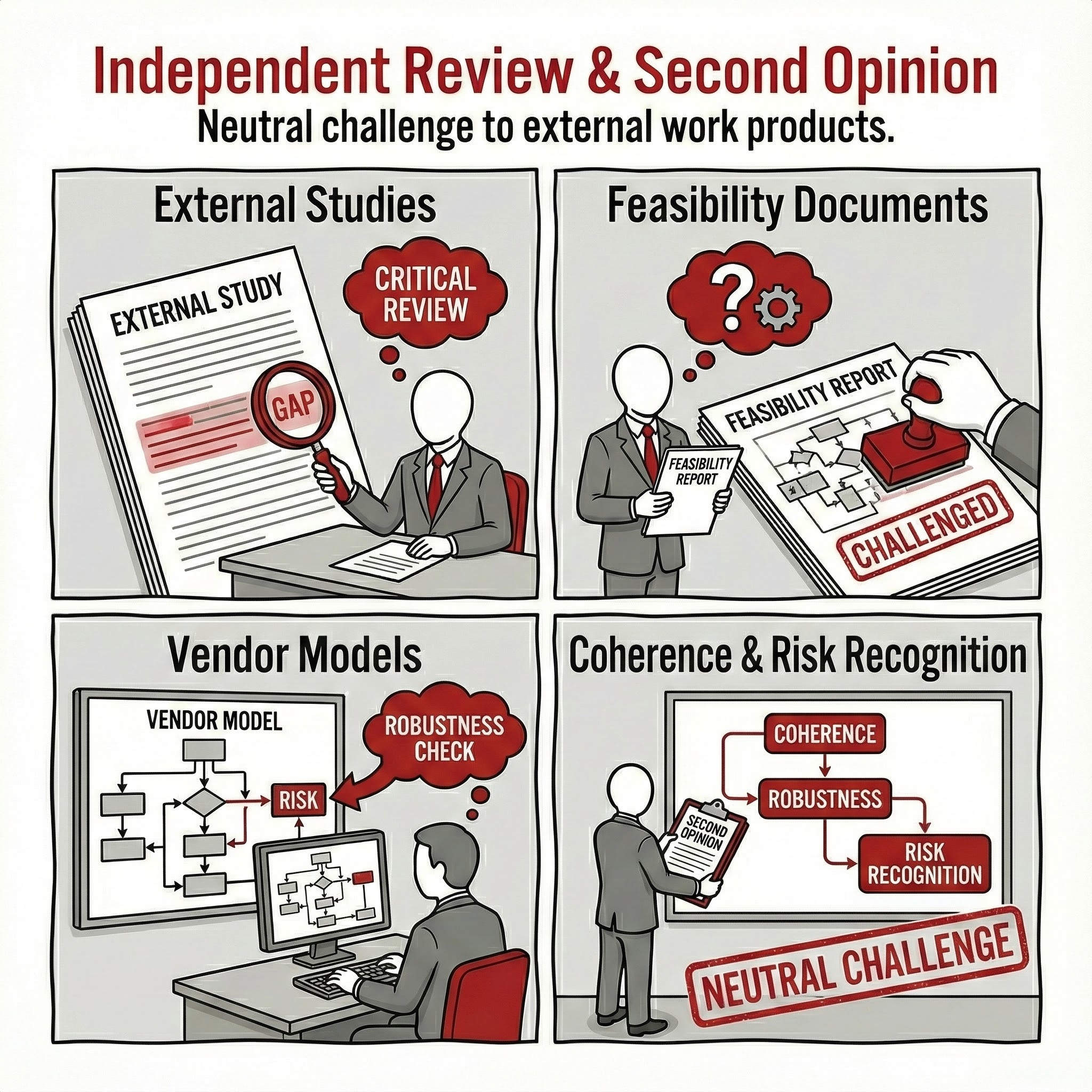

Independent Review & Second Opinion

Neutral challenge to external work products.

View Details

Independent Review & Second Opinion

Neutral challenge to external work products.

View DetailsCritical, forensic review of external studies, feasibility documents, and vendor models, designed to validate coherence, expose optimism bias, and ensure risk recognition.

The Challenge: The Agency Problem

Feasibility studies are often authored by engineering firms that stand to profit from the project's construction (EPCM). This creates an inherent incentive to understate complexity and overstate viability. Vendors, similarly, provide performance data based on ideal conditions, not industrial reality. You need a partner whose only incentive is the truth.

Our Methodology: The Forensic Coherence Check

We do not just re-read the report; we audit the structural logic of the study. We focus specifically on the "seams" between disciplines where errors usually hide:

- Cross-Disciplinary Integrity: Checking if the Mine Plan matches the Process Plant capacity, and if the Tailings Storage facility matches the waste output. We find the disconnects that siloed engineering teams miss.

- Assumption Benchmarking: Validating input assumptions (reagents, energy, labor, inflation) against our independent database of current market rates, stripping away "study-level" optimism.

- Vendor Claims Verification: challenging "black box" performance guarantees from technology providers against physics and reference plant data.

Deliverables

We provide the impartial validation required for final investment decisions:

- The Independent Review Report: A formal "Red Flag" audit highlighting fatal flaws, material omissions, and areas of weak definition.

- Gap Analysis & Scope of Work: A precise definition of what additional work is required to bring the study up to a bankable standard.

- Risk Register Overlay: A re-calibration of the project risk register, adding the systemic and execution risks often excluded by technical consultants.

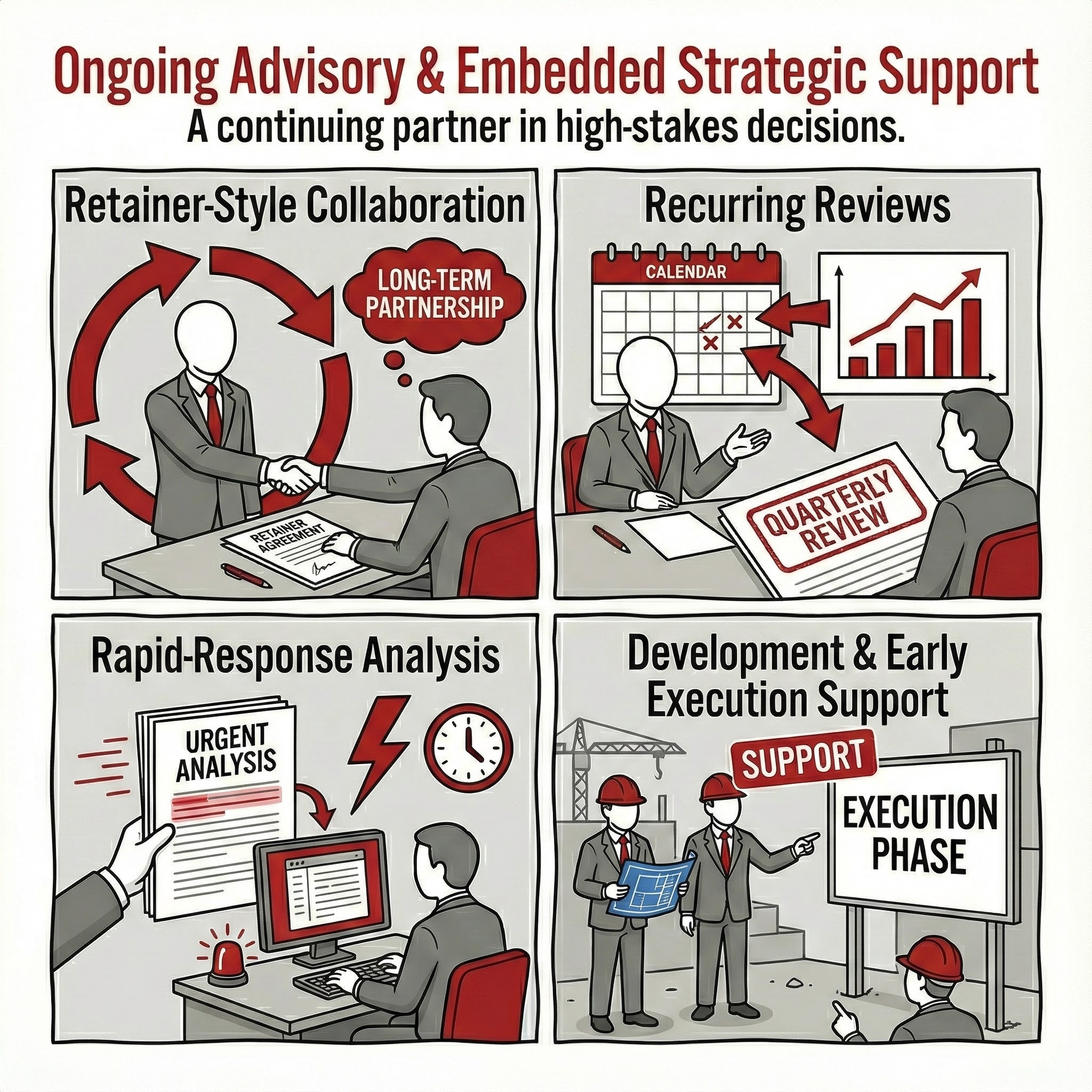

Ongoing Advisory & Embedded Strategic Support

A continuing partner in high-stakes decisions.

View Details

Ongoing Advisory & Embedded Strategic Support

A continuing partner in high-stakes decisions.

View DetailsRetainer-style collaboration model providing recurring reviews, rapid-response analysis, and embedded support across development, financing, and early execution.

The Challenge: Strategy Decay

A strategy is static; reality is dynamic. The assumptions made at the "Final Investment Decision" (FID) begin to decay the moment execution starts. Suppliers change terms, markets shift, and operational friction erodes value. Without a dedicated guardian of the strategic logic, projects drift into mediocrity or failure.

Our Methodology: The "Shadow Strategy Office"

We do not just deliver a report and leave. We integrate into your leadership structure as a "Shadow Strategy Office," providing the analytical bandwidth and independent perspective that lean project teams often lack:

- Guardian of the Business Case: We continuously monitor external variables (prices, regulations, costs) against the original model. If the thesis breaks, we are the first to raise the alarm and propose the pivot.

- Rapid Response Unit: When unexpected opportunities (e.g., a distressed asset sale, a new technology breakthrough) or threats arise, we provide immediate, high-speed evaluation (48-72 hour turnarounds) to support executive decisions.

- Steering Committee Support: We act as the independent voice in monthly Steering Committees, preventing "groupthink" and ensuring that bad news travels upstream to the Board just as fast as good news.

Deliverables

We provide continuity and institutional memory:

- Quarterly Strategic Re-Calibration: A formal update of the strategic roadmap and financial model based on the latest quarter's actual data.

- Ad-Hoc Decision Notes: Memo-style evaluations of specific tactical choices (e.g., "Buy vs. Lease," "Vendor A vs. Vendor B").

- Stakeholder Continuity: Maintaining the narrative consistency for lenders and investors as the project evolves, preventing "confidence gaps."

Service Architecture: Structuring Uncertainty

The resource, energy, and circular-economy sectors demand an integrated strategic approach, where decisions are anchored in analytical certainty rather than market conviction. Proccium’s Service Architecture is engineered to govern this complexity, establishing a continuous framework that links Industrial Strategy - the system for capital allocation and flexibility - with Strategic Project Development, the indispensable process of de-risking high-stakes investments, all built on the quantified foundation of Engineered Foresight.

This synthesis replaces fragmented advisory with a singular, disciplined system that ensures the coherence of intent, the rigor of execution, and the preservation of value under entropy.

| Discipline | Core Mandate and Value Proposition |

|---|---|

| Industrial Strategy The Architecture | Designing the system for allocating capital, managing risk, and preserving flexibility. |

| Strategic Project Development The De-Risking | Validating, structuring, and de-risking major greenfield and brownfield investments. |

| Engineered Foresight The Discipline | Developing models that quantify uncertainty to enable sound action when facts are incomplete. |

The integration of these disciplines ensures that strategy, investment, and operational plans are anchored in physics, economics, and institutional reality.

Our Commitment: Discipline Over Noise

We bring calm precision and measured experience to decisions that truly matter. Proccium replaces aspiration with structured execution.

In an environment demanding precision, we offer disciplined thinking, transparent methods, and outcomes that stand the test of reality.

The conversation begins here.

Proccium GmbHGoldschmiedgasse 6/151010 ViennaAustria

office@proccium-com+43 664 454 21 20EU VAT ID: ATU69827226Corporate Reg. Nr.: FN 418794 z