Industrial Strategy :: Managing the Business as a Whole

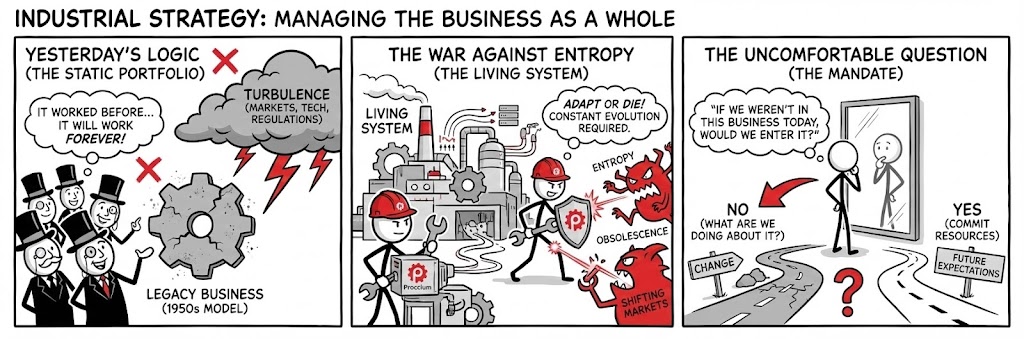

In a time of turbulence, the greatest danger is to act with yesterday’s logic. Industrial Strategy is not about predicting the future; it is about the commitment of present resources to future expectations.

At Proccium, we view the industrial enterprise as a living system fighting a constant war against entropy. Markets shift, technologies obsolesce, and regulations tighten. A static portfolio is a dying portfolio. Our mandate is to help leadership answer the most fundamental—and often uncomfortable—questions of the business: “If we were not already in this business today, would we enter it?” If the answer is no, what are we doing about it?

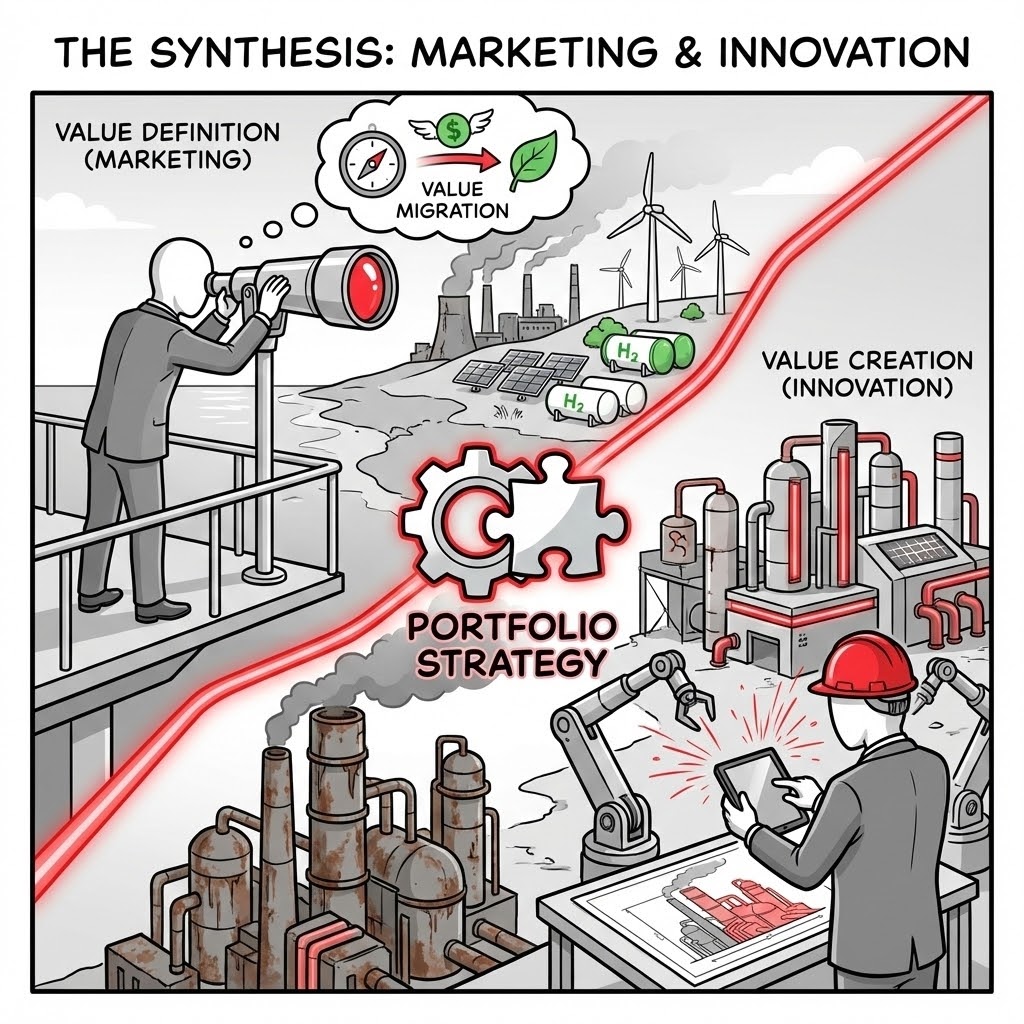

The Synthesis of Marketing and Innovation

Peter Drucker famously posited that a business has only two basic functions: Marketing and Innovation. Everything else is cost. We apply this rigorous lens to capital-intensive industries.

Value Definition (Marketing) & Value Creation (Innovation). In heavy industry, "Marketing" is not advertising; it is the deep understanding of where value will migrate in a decarbonizing world. "Innovation" is not just R&D; it is the physical restructuring of assets to meet that new value. We link these two forces into a coherent Portfolio Strategy.

Most industrial strategies fail because they decouple technical ambition from market reality. We force the synthesis:

Marketing as Value Anticipation. We analyze where profit pools are shifting. Is the value in the commodity (Green Steel), or in the certification (Carbon Credits)? We align your capital allocation with the future customer, not the legacy one.

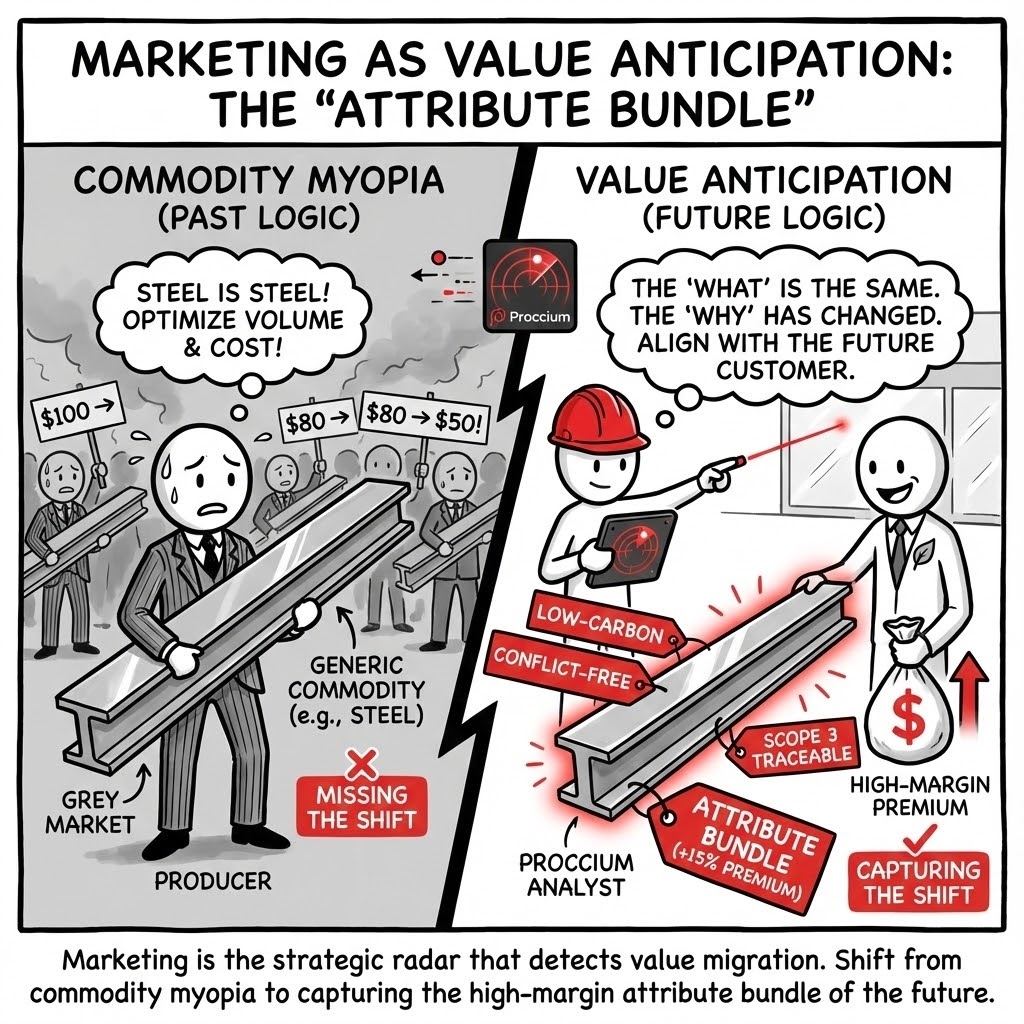

The Strategic Imperative: In the industrial transition, the "What" often remains the same (e.g., a tonne of copper), but the "Why" changes entirely. Marketing is not promotion; it is the strategic radar that detects this shift. It distinguishes between the physical product and the "Attribute Bundle" (e.g., low-carbon, conflict-free, traceable) that the customer of 2030 will actually pay for.

The Failure Mode: "Commodity Myopia." Producers often believe "Steel is Steel." They optimize for volume and cost, missing the moment when the market bifurcates. While they fight a price war in the "Grey" commodity market, competitors capture the high-margin "Green" premium, leaving the legacy player with the lowest-quality revenue.

Practical Example: A specialized alloy producer focused on "purity" as their differentiator. Our value analysis revealed that their automotive clients no longer cared about incremental purity but were desperate for "Scope 3 Traceability." By shifting strategy to certify their supply chain rather than refine their product, they captured a 15% price premium without changing the molecule.

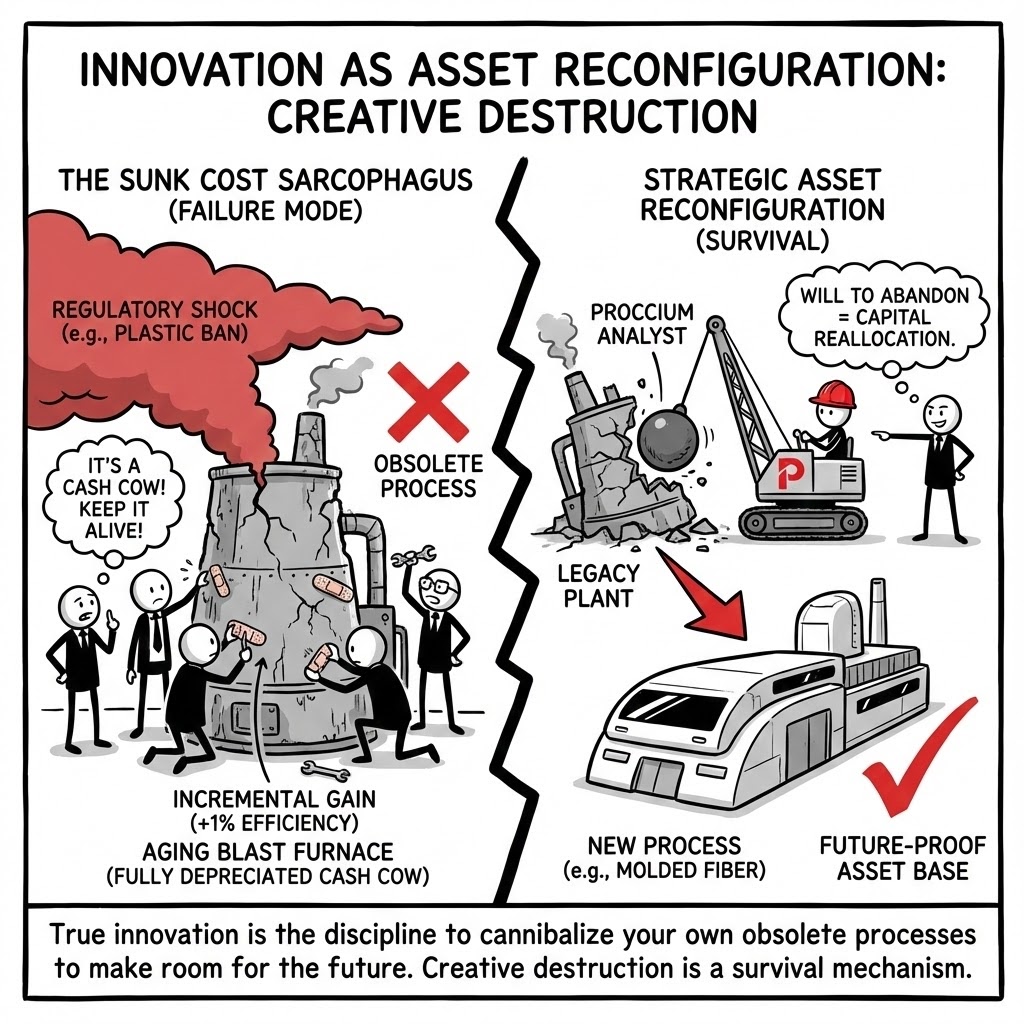

Innovation as Asset Reconfiguration. Once the target value is defined, innovation is the mechanism of delivery. This requires the "Creative Destruction" of your own asset base to retire obsolete processes and make room for the new.

The Strategic Imperative: In heavy industry, innovation is not software; it is surgery. It is the deliberate allocation of capital to make your own current cash cows obsolete. If you do not cannibalize your own business, a competitor will. True innovation requires the "Will to Abandon"—the discipline to shut down a working, cash-positive legacy plant to free up the resources (talent, capital, land) required for the future.

The Failure Mode: "The Sunk Cost Sarcophagus." Management teams often keep aging assets on life support because they are "fully depreciated cash cows." They define innovation as "continuous improvement" of the old process (e.g., making a blast furnace 1% more efficient) rather than the structural shift (e.g., switching to Hydrogen) that survival demands.

Practical Example: A packaging giant was investing heavily in R&D to make their plastic thinner (efficiency). We reframed innovation as "survival," shifting that capital to acquire a molded-fiber technology (substitution). Two years later, plastic bans hit their key markets; the efficiency gains would have been worthless, but the fiber technology saved the division.

The Three Pillars of Portfolio Resilience

While our Strategic Project Development practice focuses on the rigorous execution of individual investments, our Industrial Strategy practice focuses on the health of the Total Portfolio. We address the systemic challenges of aging assets, energy transition, and capital recycling.

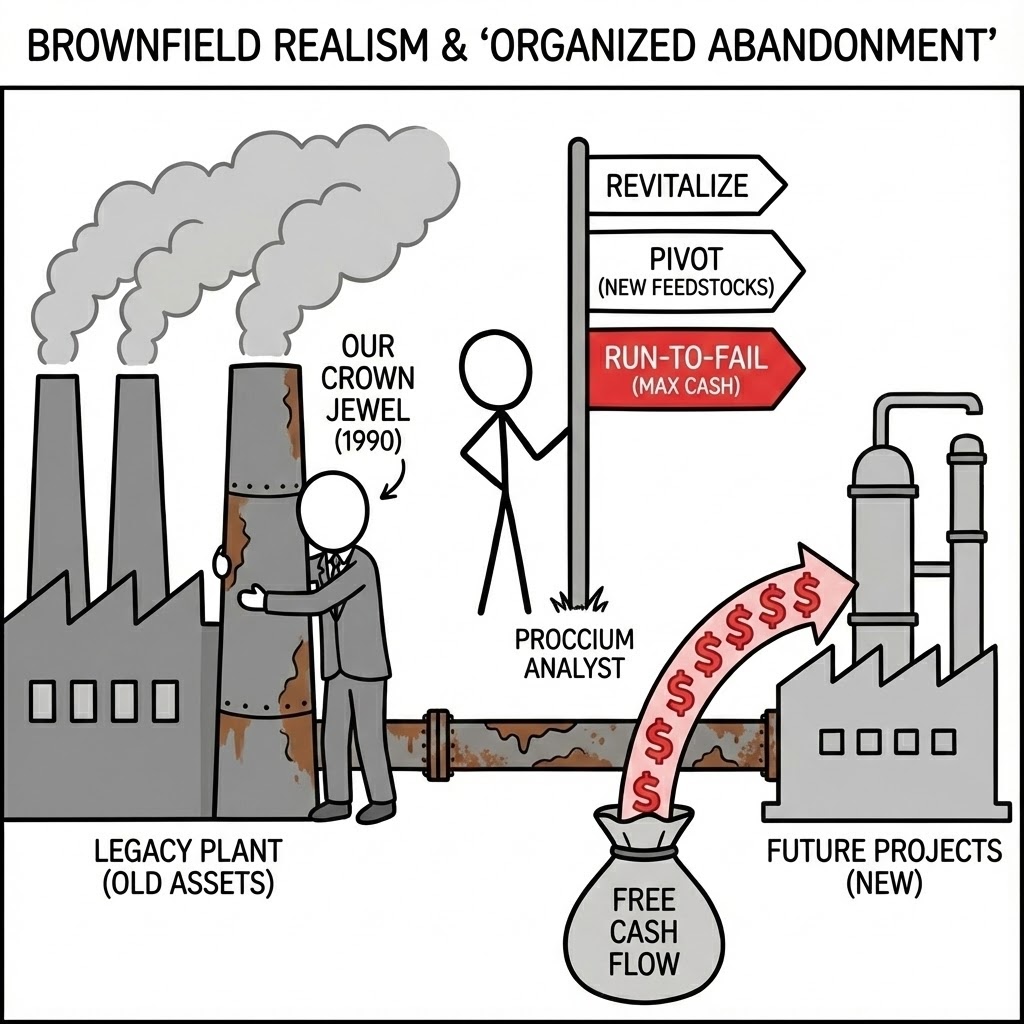

1. Brownfield Realism & "Organized Abandonment." New projects are exciting; old assets pay the bills. We determine mathematically whether to revitalize legacy assets, pivot them to new feedstocks, or manage a cash-accretive "run-to-fail" strategy.

The Strategic Imperative: The first rule of strategy is to free up resources from the past to invest in the future. "Zombie Assets"—those that consume management attention but return below the cost of capital—must be pruned. We provide the cold-eyed analysis required to make the "Keep, Fix, or Exit" decision.

The Failure Mode: "Sentimental Retention." Boards often cling to the "Crown Jewel" asset of the 1990s long after it has become a liability. By delaying the exit, they destroy the capital needed to fund the transition to new technologies.

Practical Example: A steelmaker was pouring CAPEX into an aging blast furnace to meet environmental compliance. Our analysis showed that a "Run-to-Fail" strategy—ceasing CAPEX and maximizing cash for 5 years before closure—generated $200M more free cash flow, which fully funded the equity check for a new electric arc furnace.

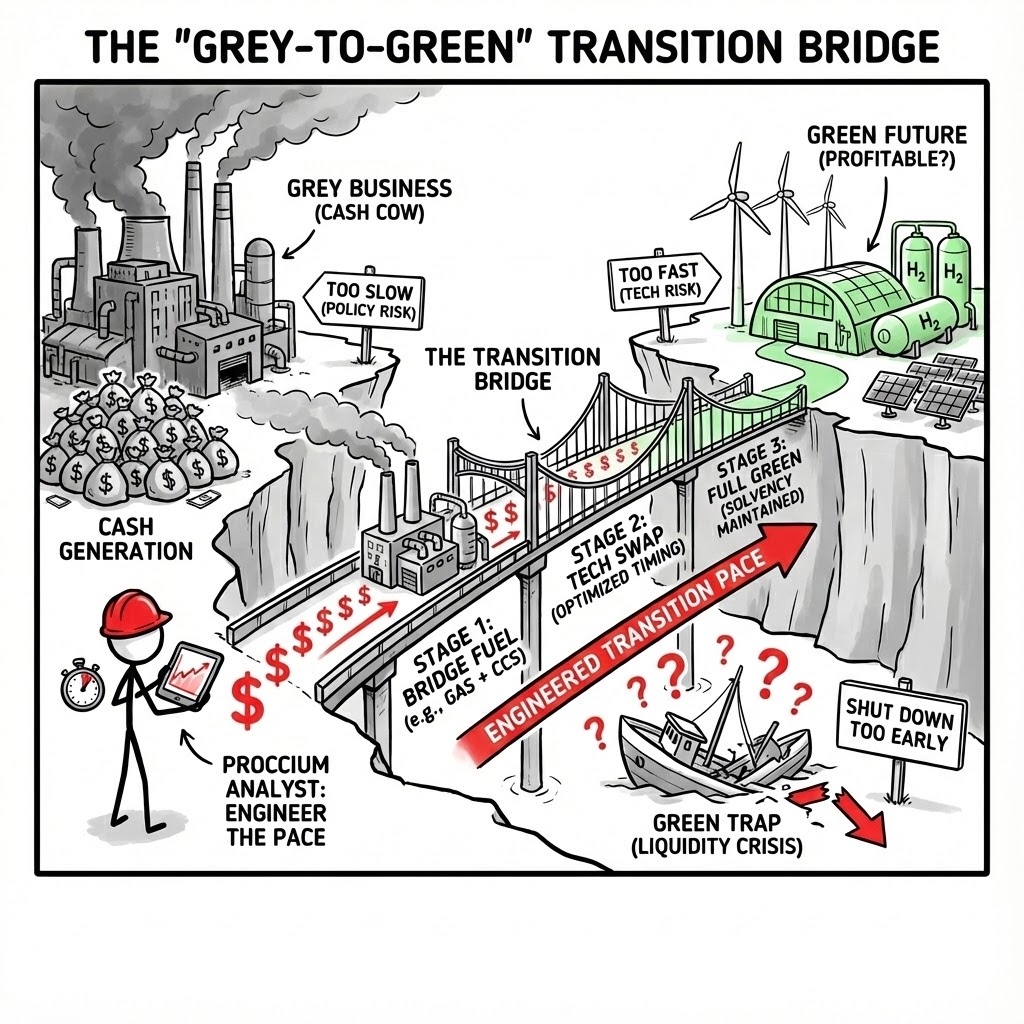

2. The "Grey-to-Green" Transition Bridge. The energy transition is an existential threat to balance sheets. Move too fast, you face technology risk; move too slow, you face policy risk. We engineer the Transition Pace.

The Strategic Imperative: Transition is not a switch; it is a bridge. You cannot shut down the cash-generating "Grey" business before the "Green" business is profitable. We model the "Bridge Fuel" strategy—optimizing the precise timing of technology swaps to maintain solvency during the crossing.

The Failure Mode: "The Green Trap." Companies often announce aggressive Net Zero targets without a viable CAPEX plan. They shut down thermal assets too early, creating a liquidity crisis that forces them to sell the company before the green future arrives.

Practical Example: A chemical major planned to switch 100% to hydrogen feedstock by 2030. Our transition model showed this would bankrupt the firm in 2028 due to high OPEX. We designed a staged transition using Natural Gas with CCS as a bridge, preserving margins while reducing emissions by 60% immediately.

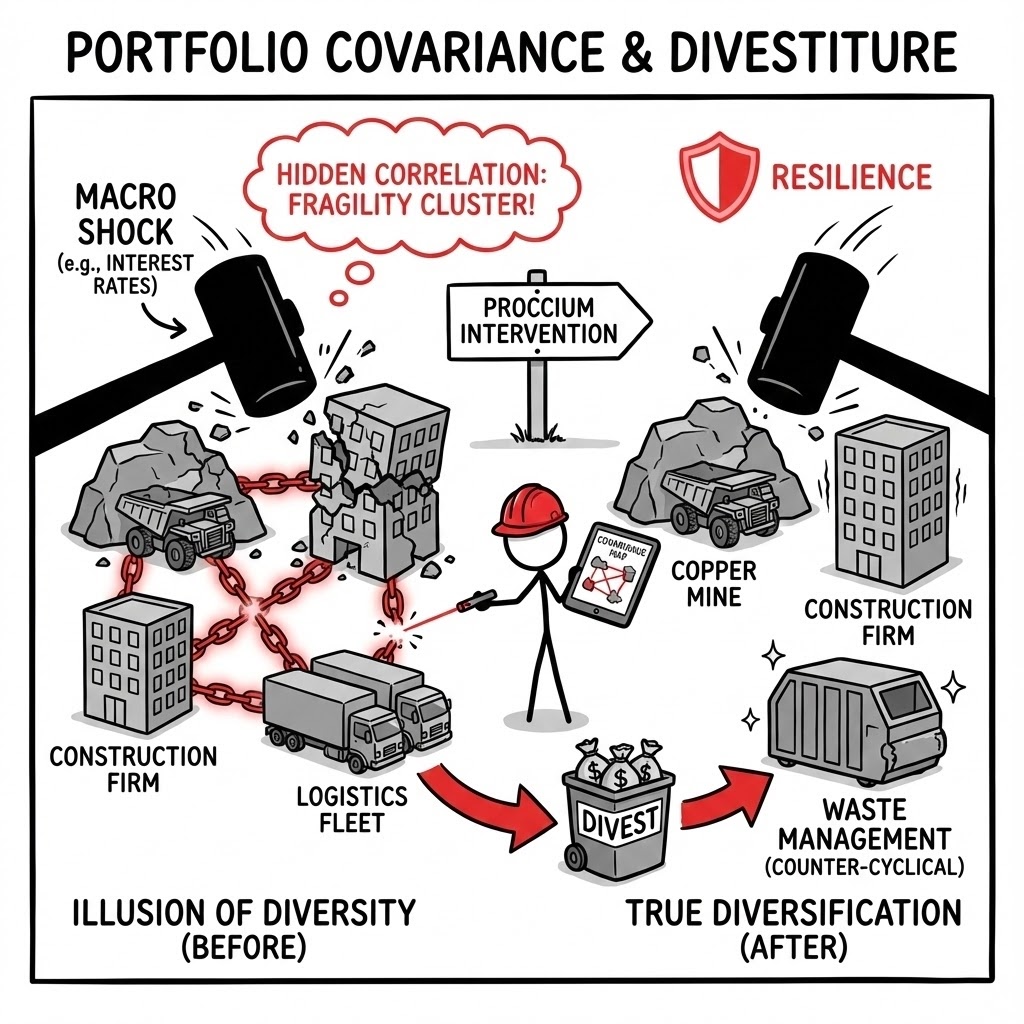

3. Portfolio Covariance & Divestiture. Most conglomerates are less diversified than they think. If all assets crash when the Dollar rises, you are not a portfolio; you are a single bet. We map hidden correlations to identify "Fragility Clusters."

The Strategic Imperative: True diversification reduces the risk of the whole below the average risk of the parts. We analyze the covariance of your assets against macro-shocks (Inflation, Energy Prices, Geopolitics). If Asset A and Asset B both fail in the same scenario, one must be sold to buy Asset C, which thrives in that scenario.

The Failure Mode: "Illusion of Diversity." A holding company owning a copper mine, a construction firm, and a logistics fleet thought it was diversified. In reality, all three were highly sensitive to interest rates. When rates rose, the entire portfolio collapsed simultaneously.

Practical Example: We advised a family office to divest a profitable logistics unit because its risk profile (fuel price sensitivity) was 95% correlated with their core manufacturing business. They redeployed the capital into a waste-management utility (counter-cyclical), significantly lowering the volatility of the group.

Inorganic Architecture: M&A as Industrial Integration

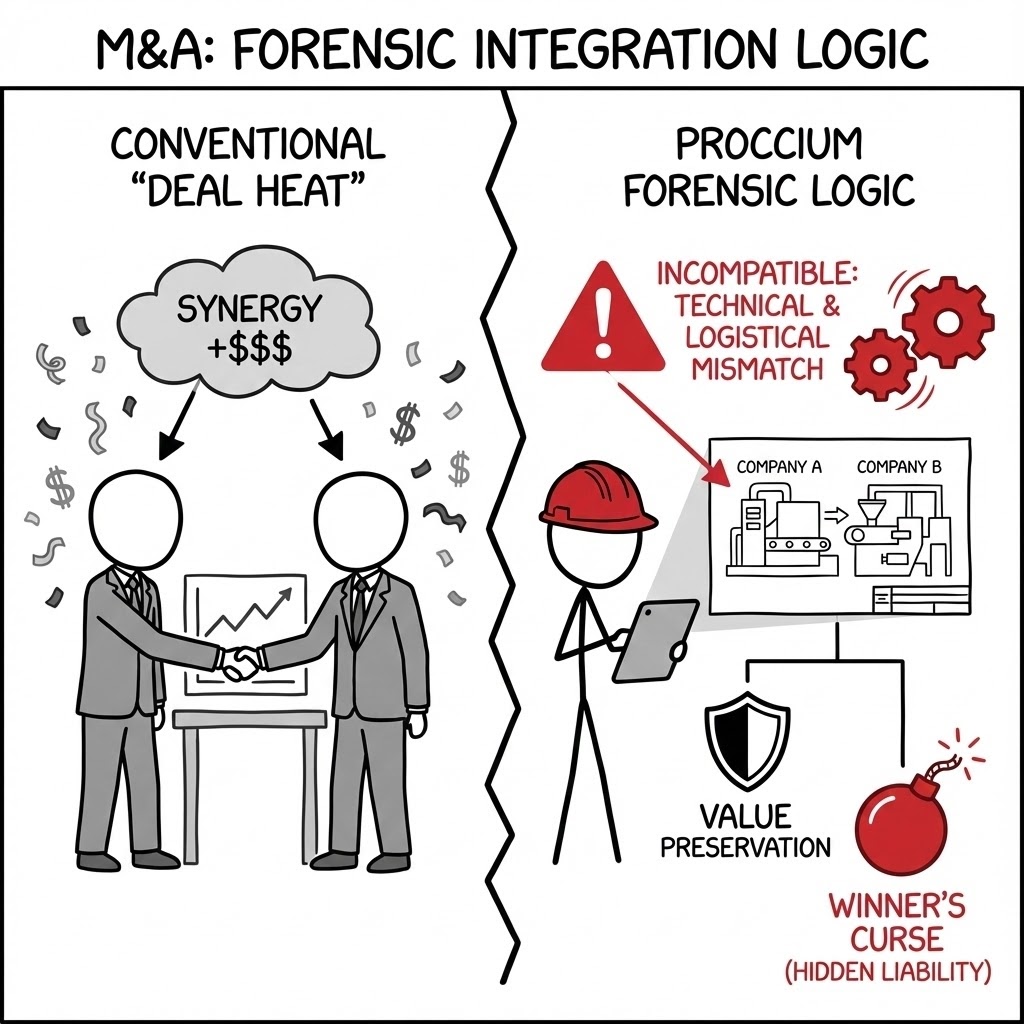

Strategy is not limited to what you can build yourself. Mergers and Acquisitions are powerful levers for capability acquisition, but only if they adhere to industrial logic. We reject the “Deal Heat” of investment banking in favor of Forensic Integration Logic.

We do not broker deals; we validate the industrial thesis behind them. We treat M&A as an engineering problem: looking past the "synergy" slide to verify the physical, logistical, and technical compatibility of the target. We intervene to prevent the "Winner's Curse"—paying a premium for an asset that is statistically guaranteed to destroy value.

Most M&A fails not on price, but on physics and culture. We provide the "Industrial Second Opinion" that investment banks cannot offer:

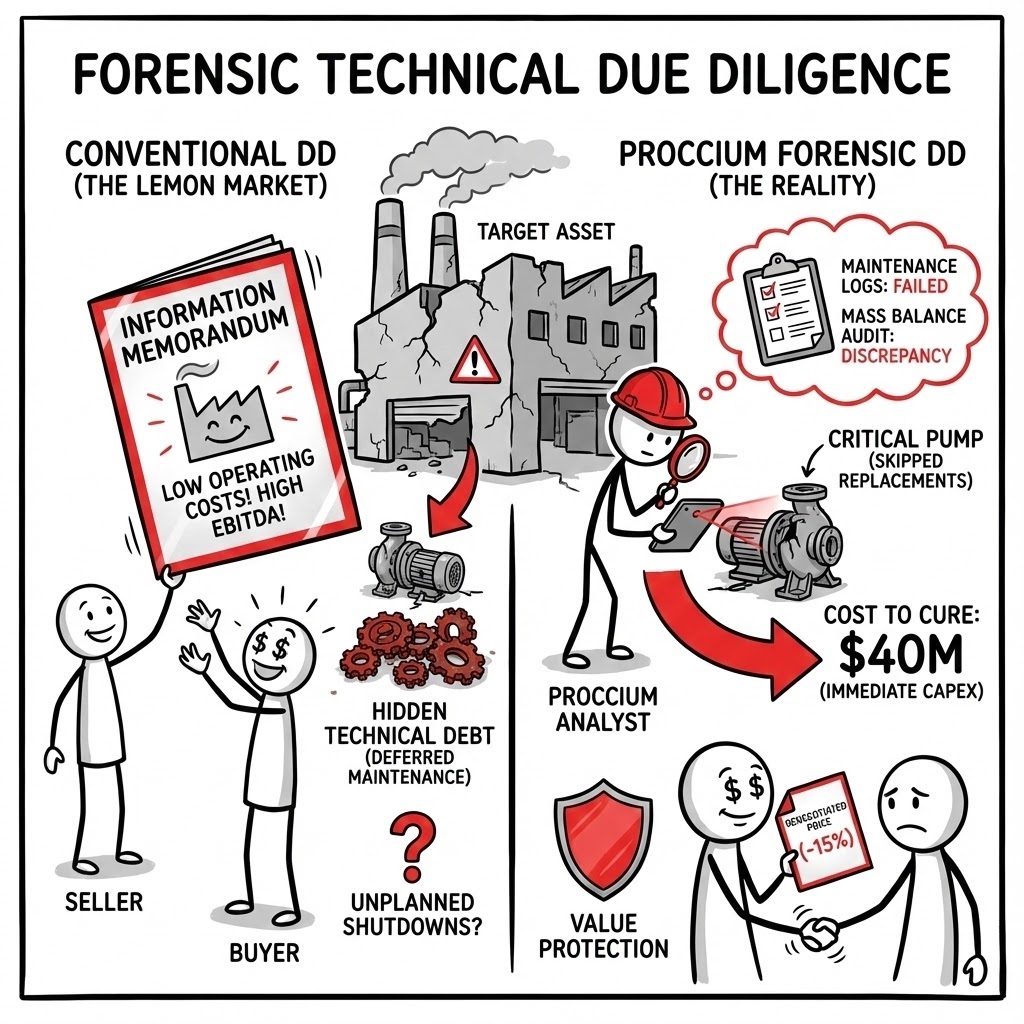

Forensic Technical Due Diligence. We ignore the Information Memorandum. We go to the site, review the maintenance logs, and audit the mass balances to find the "Technical Debt" hidden in the target's balance sheet.

The Strategic Imperative: In industrial M&A, you are buying the asset's history. Has maintenance been deferred to dress up EBITDA for the sale? Is the "Nameplate Capacity" actually achievable? We quantify the "Cost to Cure"—the immediate CAPEX injection required to bring the asset up to your safety and operational standards—and deduct it from the valuation.

The Failure Mode: "The Lemon Market." The seller always knows more about the rust than the buyer. Relying on high-level vendor reports leads to acquiring assets that require massive unplanned shutdowns in Year 1, destroying the deal rationale immediately.

Practical Example: A client planned to acquire a chemical plant based on its "low operating costs." Our forensic review of the maintenance logs revealed that the low costs were due to skipping critical pump replacements for 3 years. We calculated a $40M "deferred maintenance liability," allowing the client to renegotiate the purchase price down by 15%.

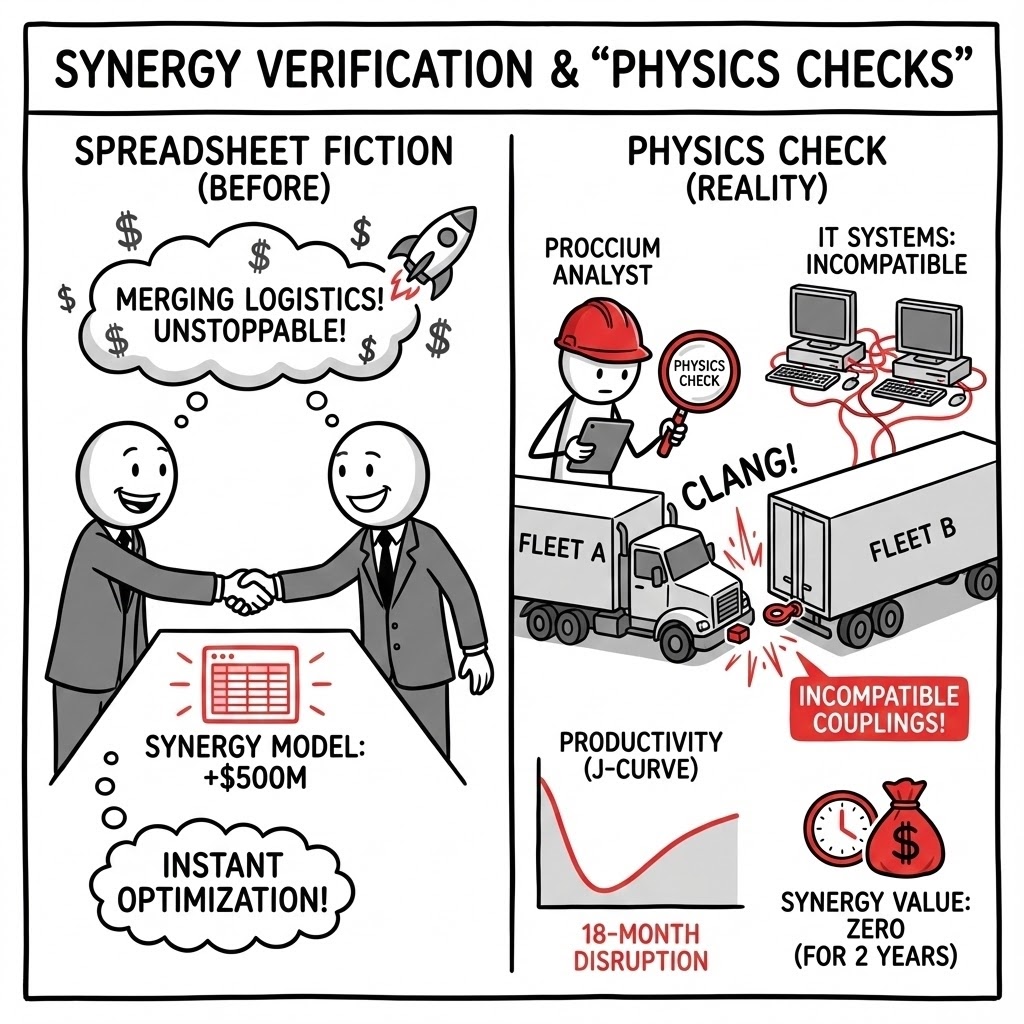

Synergy Verification & "Physics Checks." Synergy is often a spreadsheet fiction used to justify a high premium. We stress-test operational synergies against logistical and physical reality before the check is signed.

The Strategic Imperative: Synergies must be physical, not just financial. "Merging logistics" sounds great until you realize Fleet A uses different couplings than Fleet B. We validate the interoperability of the assets. If the "integration" requires 3 years of re-tooling, the Net Present Value (NPV) of the synergy is likely zero.

The Failure Mode: "Integration Friction." The deal model assumes synergies start Day 1. Reality dictates that mixing two different operational cultures (e.g., a safety-first miner vs. a speed-first contractor) causes productivity to drop for 18 months. We model this "J-Curve" of disruption to prevent liquidity shocks post-merger.

Practical Example: Two regional logistics firms merged to "optimize routes." Our analysis showed that their IT systems for route planning were incompatible and would take 2 years to bridge. We advised the Board to treat the synergy value as zero for the first 24 months, fundamentally changing the debt structure of the deal to ensure survival.

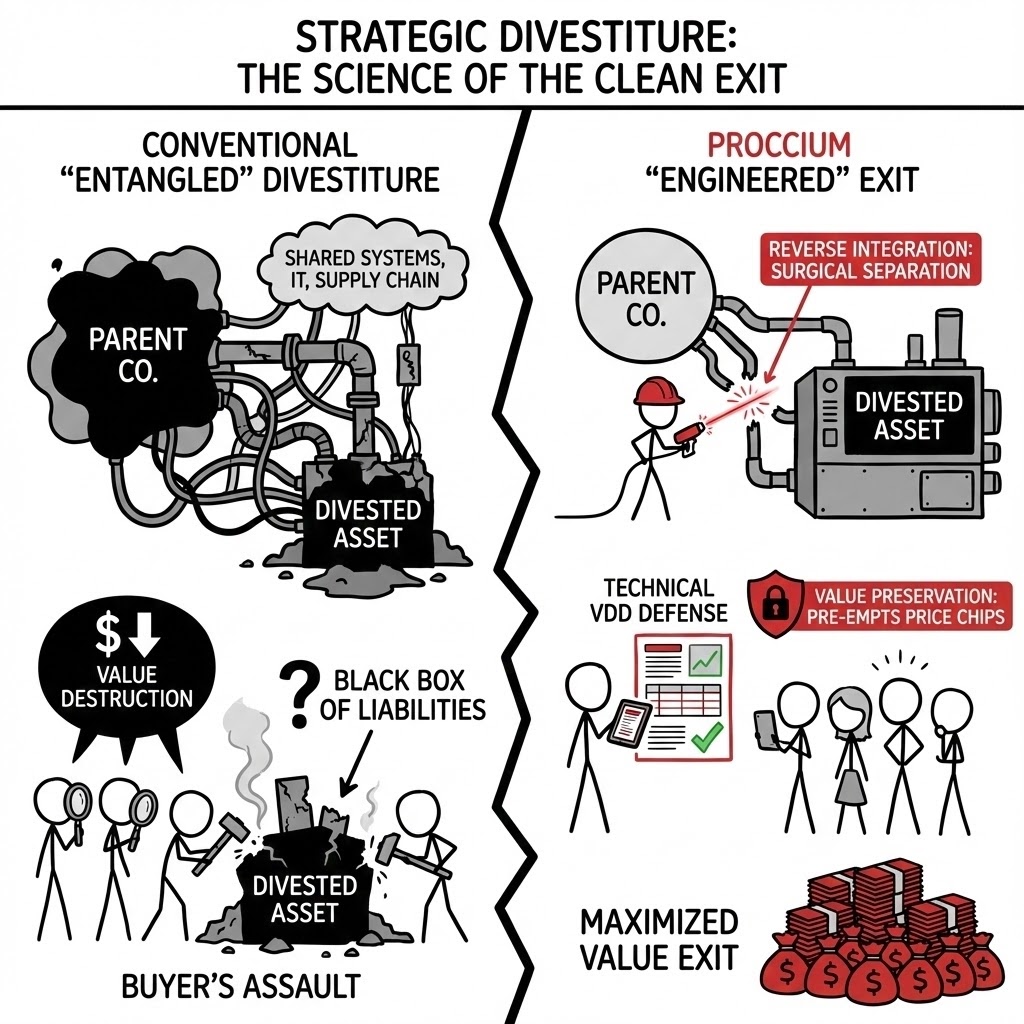

Strategic Divestiture: The Science of the Clean Exit

Buying is easy; selling well is hard. Most industrial divestitures destroy value because the asset is “entangled” with the parent company or because the growth story collapses under technical scrutiny. We do not find the buyer (that is the banker’s job); we engineer the asset to withstand the buyer’s assault.

We treat divestiture as "Reverse Integration." We surgically separate the asset’s operations from the parent to ensure it is standalone-viable, and we construct a Technical Vendor Due Diligence (VDD) defense that pre-empts price chips. We ensure you sell a robust industrial machine, not a black box full of liabilities.

The moment a buyer's technical team finds a flaw, the price drops. We prevent this value leakage by performing the audit before they do.

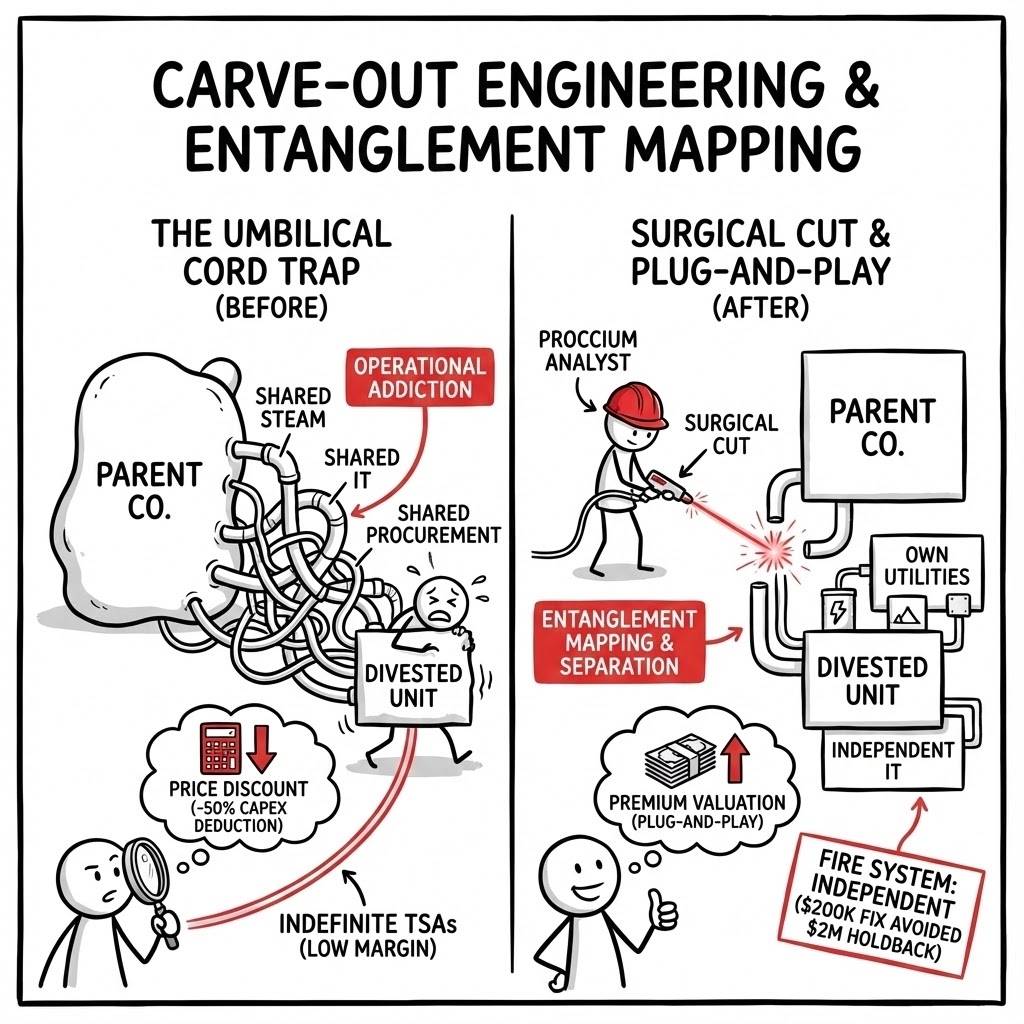

Carve-Out Engineering & Entanglement Mapping. Assets are often operationally addicted to their parent (shared steam, IT, procurement). We design the "Surgical Cut" to ensure the sold unit functions on Day 1 without costly Transitional Service Agreements (TSAs).

The Strategic Imperative: A "messy" asset trades at a discount. If a buyer sees they have to build their own water treatment plant because the current one is shared with the parent, they deduct that CAPEX from the purchase price—often with a 50% safety margin. We engineer the separation beforehand to fence-off the asset, creating a "Plug-and-Play" acquisition target that commands a premium.

The Failure Mode: "The Umbilical Cord Trap." The deal is signed, but the divested unit collapses because it relied on the parent's maintenance team or software licenses. The seller is forced into indefinite, low-margin support contracts (TSAs) that drag on for years, preventing a clean exit.

Practical Example: A conglomerate was selling a rolling mill. We discovered the mill's fire-suppression system was physically piped into the parent's adjacent chemical plant. We managed the $200k re-piping project pre-sale. Had the buyer discovered this during DD, they would have held back $2M in escrow for "unknown safety interdependencies."

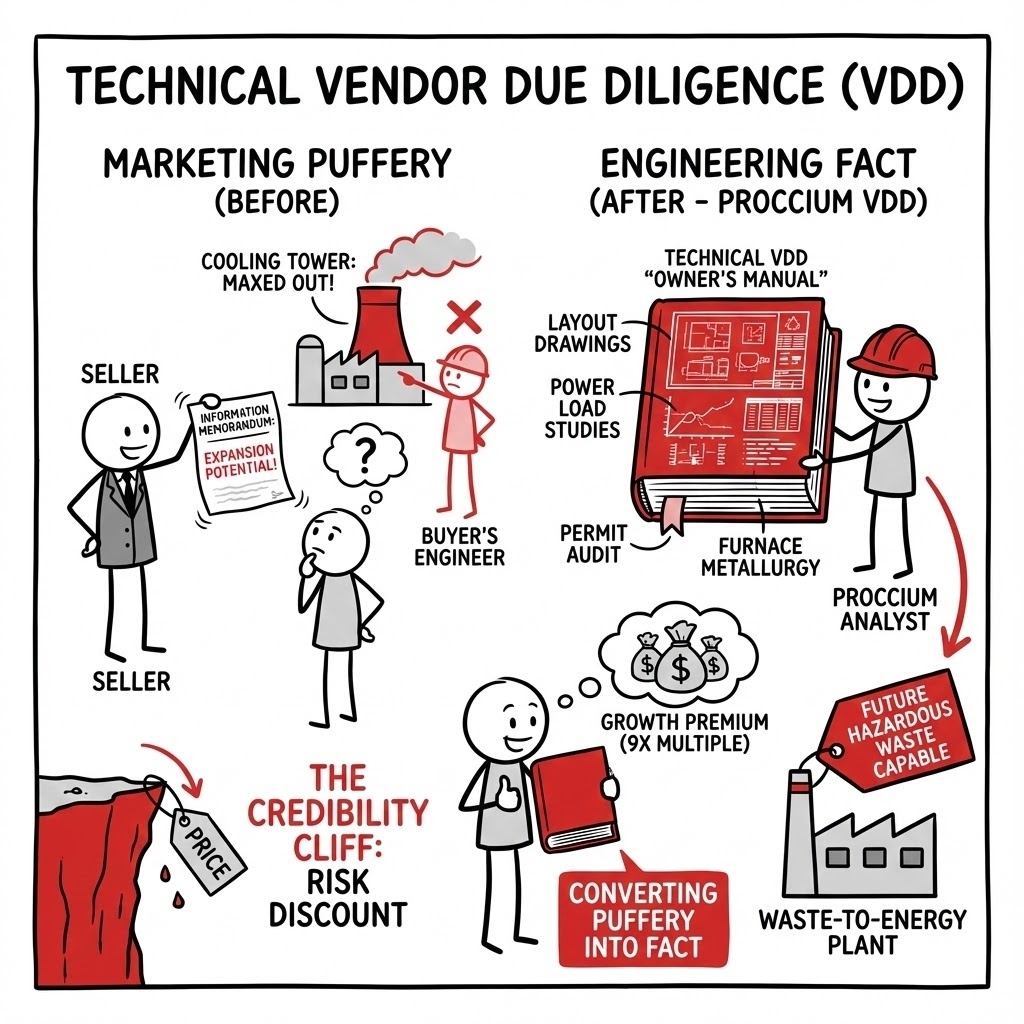

Technical Vendor Due Diligence (VDD). We write the "Owner's Manual" for the sale. We rigorously validate the upside potential (e.g., expansion capacity, efficiency gains) so it stands up to the buyer's engineers, preserving the "Growth Premium."

The Strategic Imperative: Bankers sell financial projections; we sell physical possibility. If the Information Memorandum claims "Expansion Potential," we provide the layout drawings and power load studies that prove it fits. We convert "Marketing Puffery" into "Engineering Fact," forcing the buyer to pay for the upside potential because they cannot argue it doesn't exist.

The Failure Mode: "The Credibility Cliff." A seller claims a plant can produce 20% more. The buyer's engineer visits and sees the cooling tower is maxed out. Credibility evaporates. The buyer now doubts every number in the data room, leading to a massive "Risk Discount" on the final bid.

Practical Example: A client selling a waste-to-energy plant claimed it could handle "future hazardous waste streams." We pre-audited the permit and the furnace metallurgy, creating a "Technical Databook" proving the capability existed. This allowed the investment bank to market the asset to specialized hazardous waste players at a 9x multiple, rather than standard utility players at a 6x multiple.

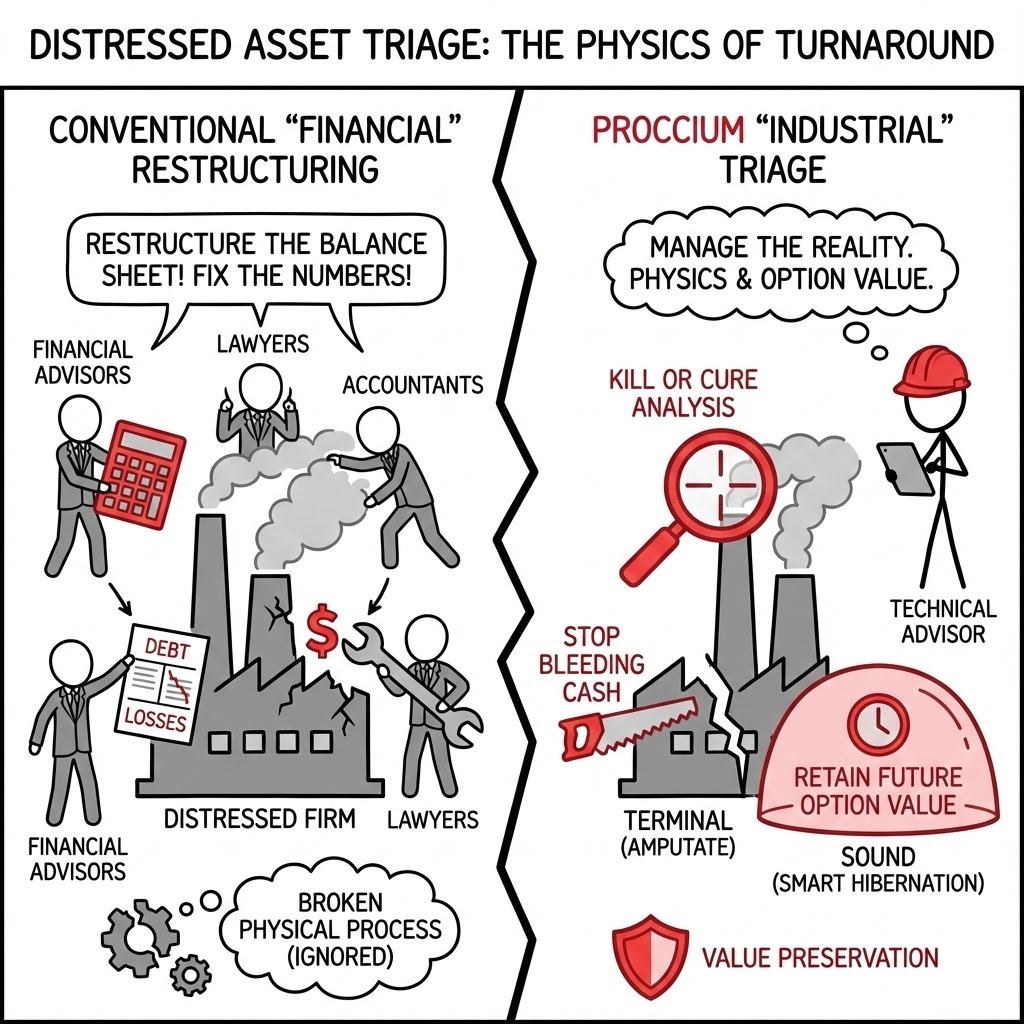

Distressed Asset Triage: The Physics of Turnaround

When an industrial firm enters distress, financial advisors rush to restructure the balance sheet. But financial engineering cannot fix a broken physical process. We provide Industrial Triage—determining which assets are fundamentally sound but mismanaged, and which are structurally terminal and must be amputated.

We act as the Technical Advisor to the Restructuring. While lawyers and accountants manage the creditors, we manage the reality. We deploy rigorous "Kill or Cure" analysis to stop the bleeding of cash into unviable assets, while designing "Smart Hibernation" strategies for assets that retain future option value.

Distress is the ultimate test of strategy. It requires the rapid, unsentimental decoupling of "Hope" from "Physics."

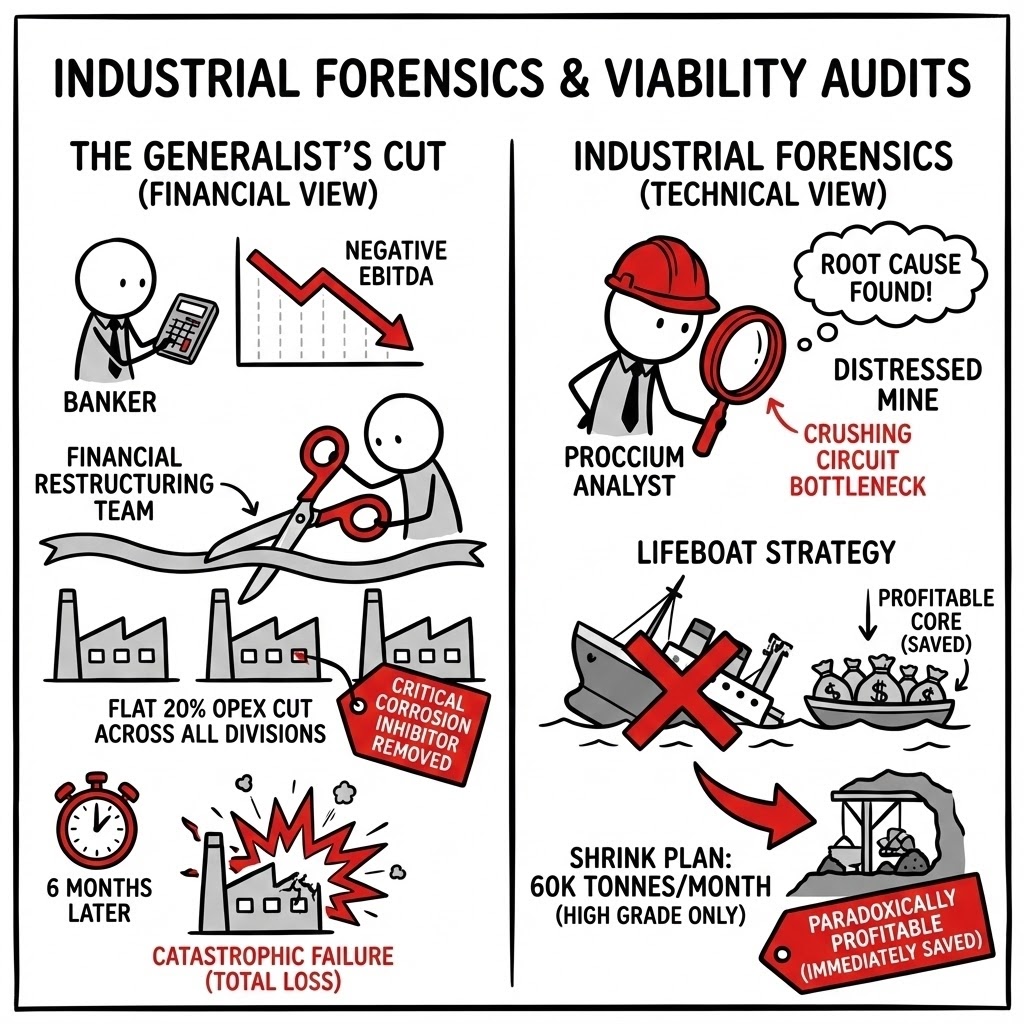

Industrial Forensics & Viability Audits. Bankers see negative EBITDA; we see the root cause. We distinguish between "Cyclical Distress" (good asset, bad market) and "Structural Obsolescence" (bad asset). We provide the definitive verdict on whether a turnaround is physically possible.

The Strategic Imperative: In a crisis, cash is oxygen. The most common error is spreading limited cash across all assets to "keep them alive." This kills the whole firm. We force a "Lifeboat Strategy"—identifying the profitable core that can be saved and scientifically validating that its unit economics work before you bet the remaining liquidity on it.

The Failure Mode: "The Generalist's Cut." A financial restructuring team orders a flat 20% OPEX cut across all divisions. In a chemical plant, this indiscriminate cut might remove the critical corrosion inhibitor, causing the asset to physically fail six months later, turning a financial problem into a catastrophic total loss.

Practical Example: A distressed mining junior was burning cash trying to mine 100k tonnes/month at low grade. Our forensic audit showed the crushing circuit was the bottleneck. We advised shrinking the mine plan to 60k tonnes/month (high grade only). This paradoxically made the mine profitable immediately, saving the company from liquidation.

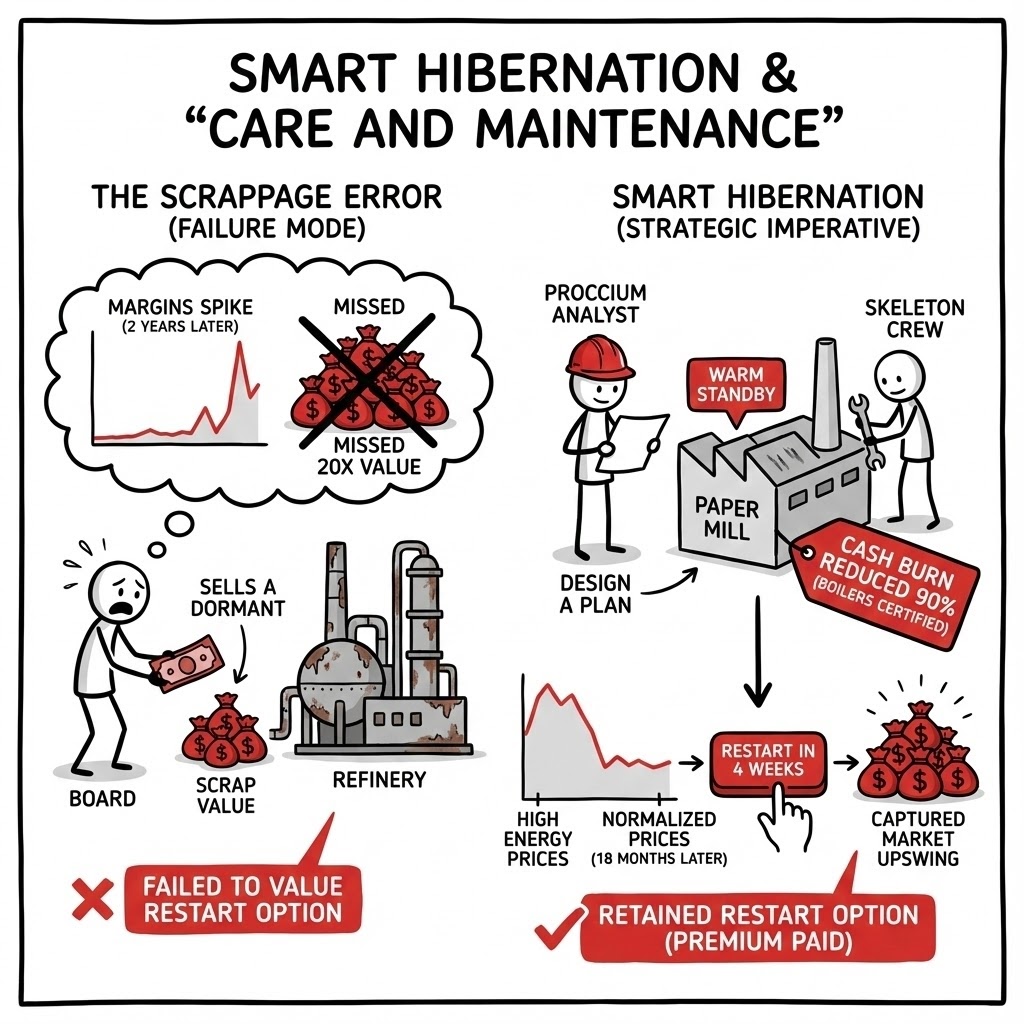

Smart Hibernation & "Care and Maintenance." Closing a plant is expensive; destroying its future value is worse. We design "Preservation Architectures" that allow you to mothball an asset at minimum cost while retaining the **Real Option** to restart it when the cycle turns.

The Strategic Imperative: Distress is often temporary (e.g., a 2-year dip in lithium prices). If you simply lock the gates, the equipment rusts and the permits lapse—you have destroyed the option value. We calculate the "Holding Cost" required to keep the asset in a "Warm Standby" state vs. a "Cold Closure," treating the preservation cost as the premium paid to keep the restart option alive.

The Failure Mode: "The Scrappage Error." Desperate for cash, a board sells a dormant refinery for scrap value. Two years later, margins spike, and that asset would have been worth 20x the scrap price. They failed to value the "Restart Option."

Practical Example: A paper mill was bleeding cash due to high energy prices. Instead of a permanent shutdown (which would trigger huge remediation liabilities), we designed a "Skeleton Crew" hibernation plan. This reduced cash burn by 90% but kept the boilers certified. When energy prices normalized 18 months later, they restarted in 4 weeks, capturing a market upswing competitors missed.

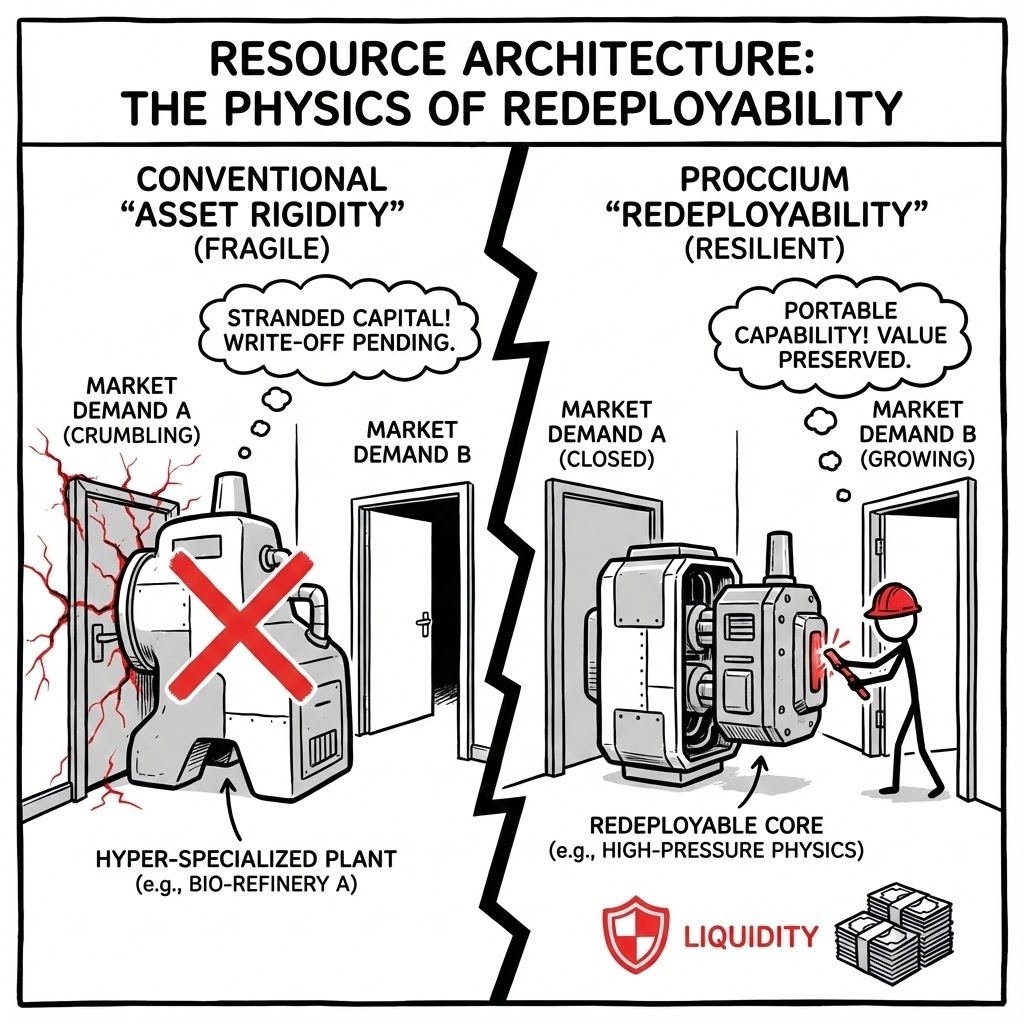

Resource Architecture: The Physics of Redeployability

Conventional strategy focuses on where to compete. We focus on how resources flow between competitions. In a volatile world, the static allocation of capital is dangerous. Survival depends on Resource Liquidity—the ability to redeploy capital, talent, and technical capacity from declining sectors to growing ones without destroying value in the transfer.

We reject vague notions of "synergy." Instead, we map the "underlying physics" of your portfolio. We identify which capabilities are truly portable (e.g., high-pressure thermodynamics) and which are context-dependent (e.g., coal boiler maintenance). We design the organization to maximize the Redeployability Premium, ensuring that if one market closes, your assets have a pre-engineered exit path.

Most conglomerates suffer from "Asset Rigidity." When a business unit fails, the assets trapped inside it—specialized talent, intellectual property, and equipment—are written off because they cannot be decoupled. We engineer the portfolio to prevent this:

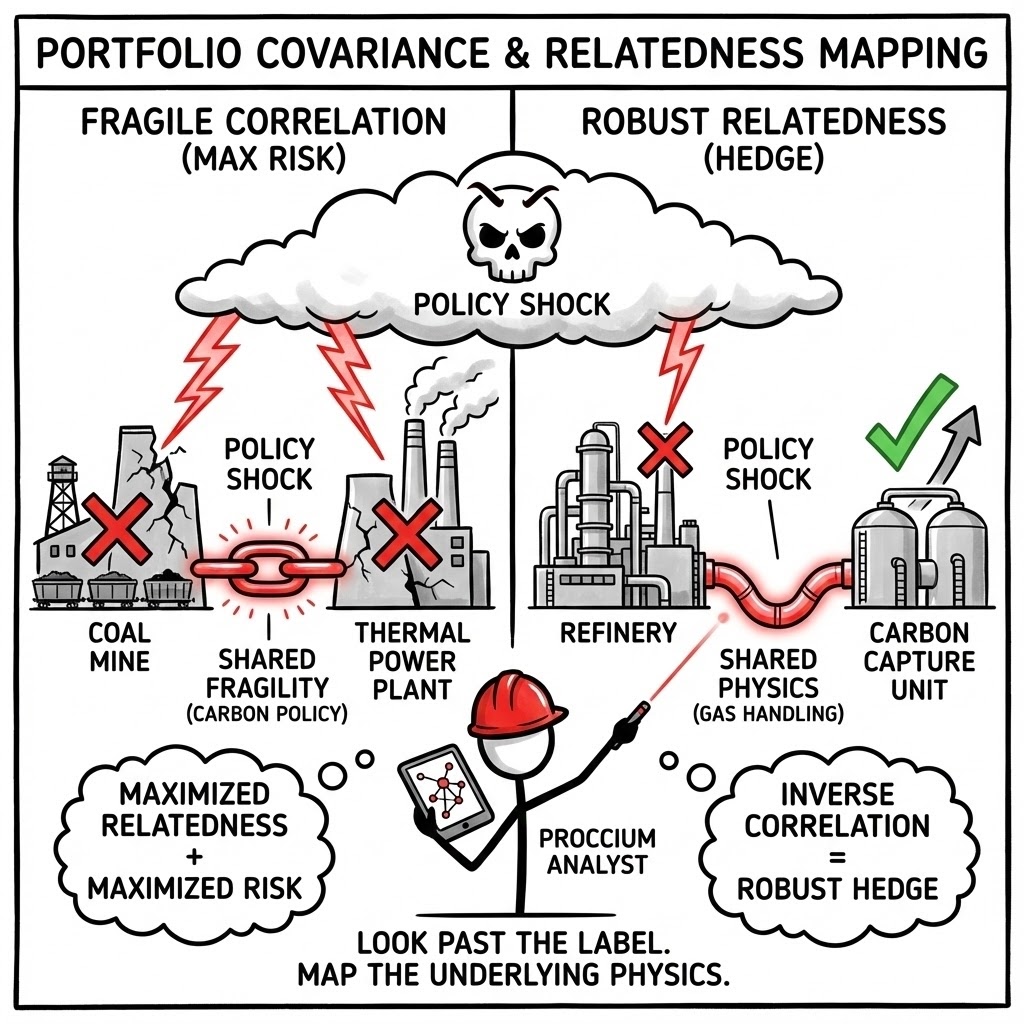

Portfolio Covariance & Relatedness Mapping. We look past the industry label to the underlying industrial process. We identify hidden correlations where seemingly diverse assets share the same fragility (e.g., energy intensity) and hidden relatedness where different assets share the same technical core.

The Strategic Imperative: True relatedness provides a hedge. If you own a Refinery and a Carbon Capture unit, they are related by gas handling physics but inversely correlated by carbon policy. This is a robust portfolio. If you own a Coal Mine and a Thermal Power Plant, you have maximized relatedness but also maximized risk.

The Failure Mode: "The Conglomerate Discount." A company owns five businesses that share nothing but a logo. There is no transfer of knowledge or resources. The holding company adds cost, not value. The market rightly values the whole less than the sum of the parts.

Practical Example: A drilling services company realized their core competency wasn't "Oil & Gas" but "subsurface geophysics." By redeploying their data scientists to the Geothermal and Carbon Storage sectors, they pivoted 40% of their revenue away from fossil fuels without firing their core technical staff.

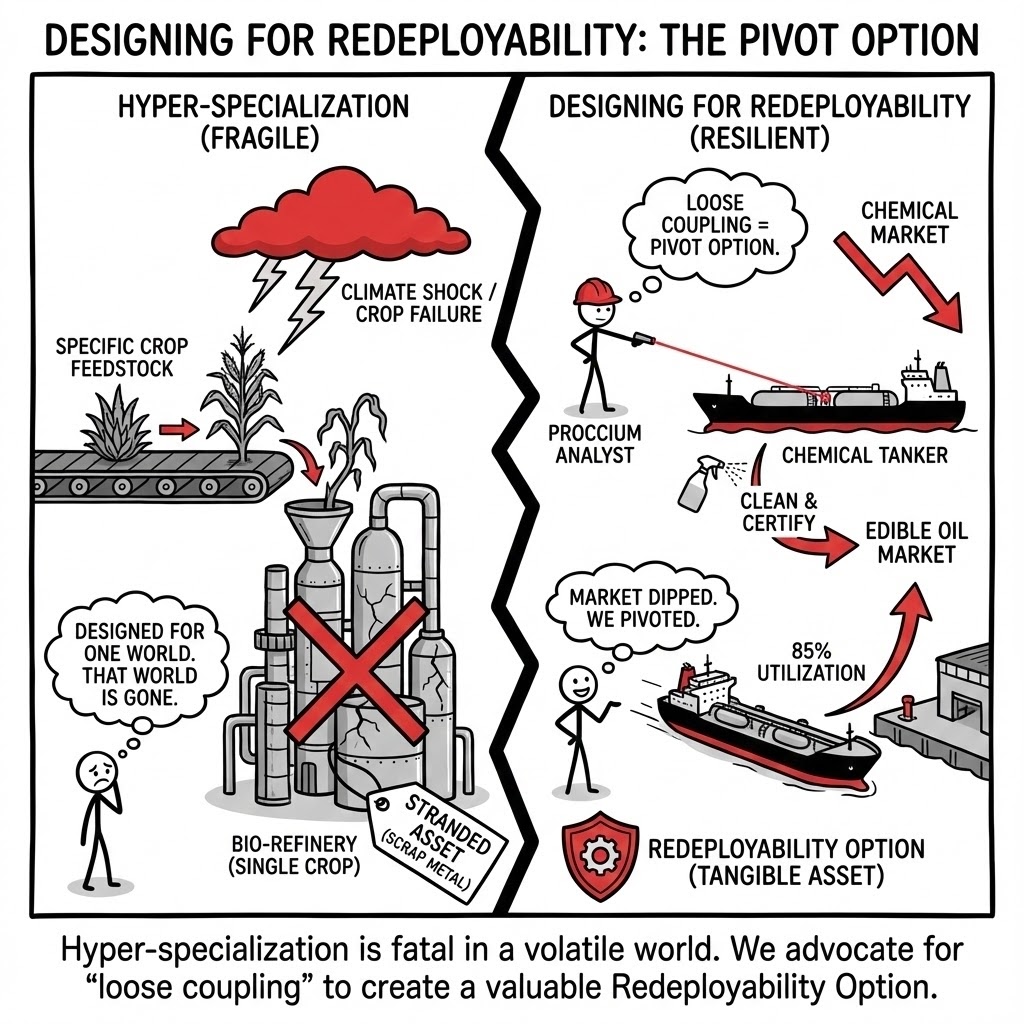

Designing for Redeployability (The Pivot Option). We value assets based on their "Second Best Use." We push for technical specifications that maintain optionality, avoiding hyper-specialization that locks an asset into a single, potentially obsolete market.

The Strategic Imperative: Hyper-specialization is efficient in a stable world but fatal in a volatile one. We advocate for "loose coupling" in industrial design—building plants and teams that can switch feedstocks, outputs, or markets with minimal friction cost. This "Redeployability Option" is a tangible asset on the balance sheet.

The Failure Mode: "The Stranded Asset." A bio-refinery is built to process only one specific type of crop. When that crop fails due to climate change, the multi-million dollar stainless steel facility becomes scrap metal. A slightly less "efficient" but more flexible design would have survived.

Practical Example: A logistics client was building a fleet of specialized chemical tankers. We advised a design modification that allowed the tanks to be cleaned and certified for food-grade transport. When the chemical market dipped, they redeployed the fleet to transport edible oils, maintaining 85% utilization while competitors idled.

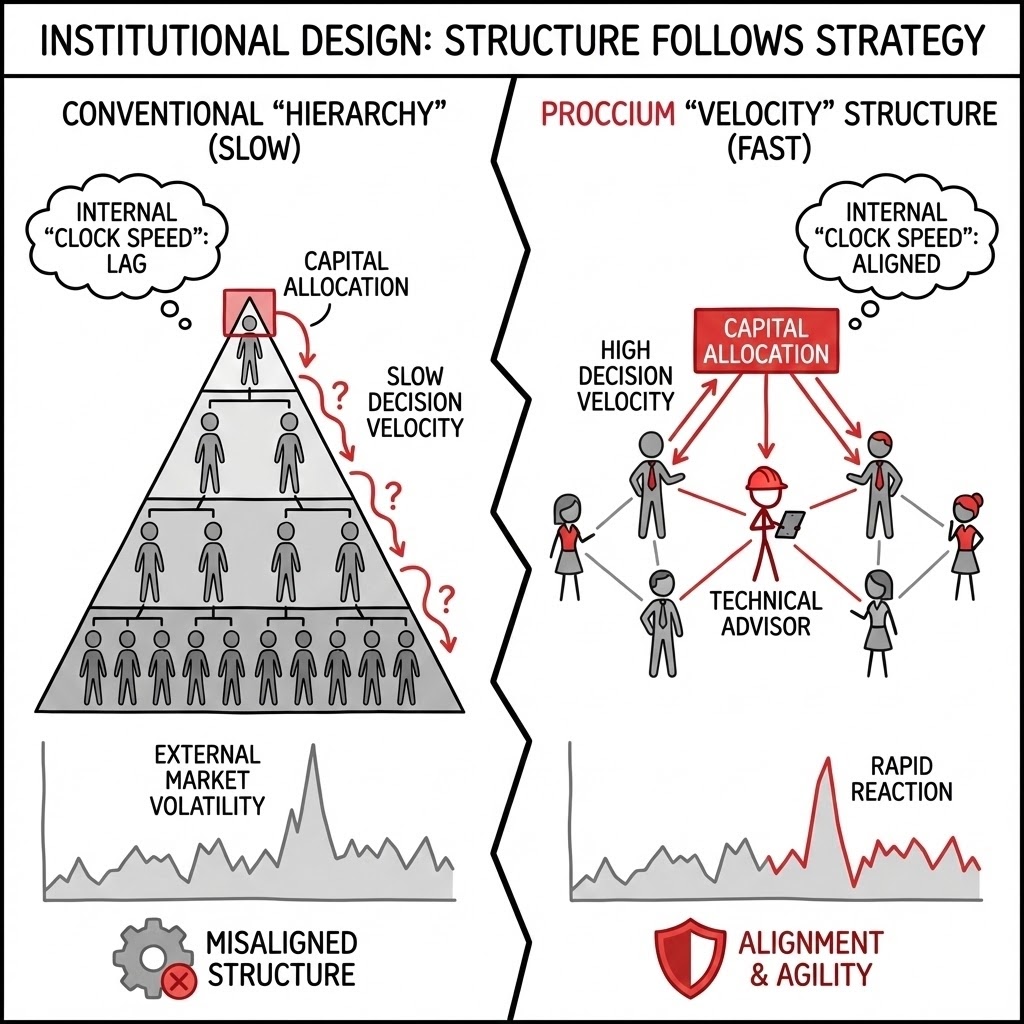

Institutional Design: Structure Follows Strategy

A strategy that cannot be executed is merely an intent. As Drucker noted, “Culture eats strategy for breakfast,” but Structure determines Culture. We extend our strategic advisory into the design of the organization itself.

We redesign organizational charts not based on hierarchy, but on decision velocity and resilience. We align the internal "clock speed" of the firm with the volatility of the external market, ensuring that decision rights and information flows are structured to execute the strategy, not hinder it.

We address the structural bottlenecks that convert strategic intent into organizational paralysis:

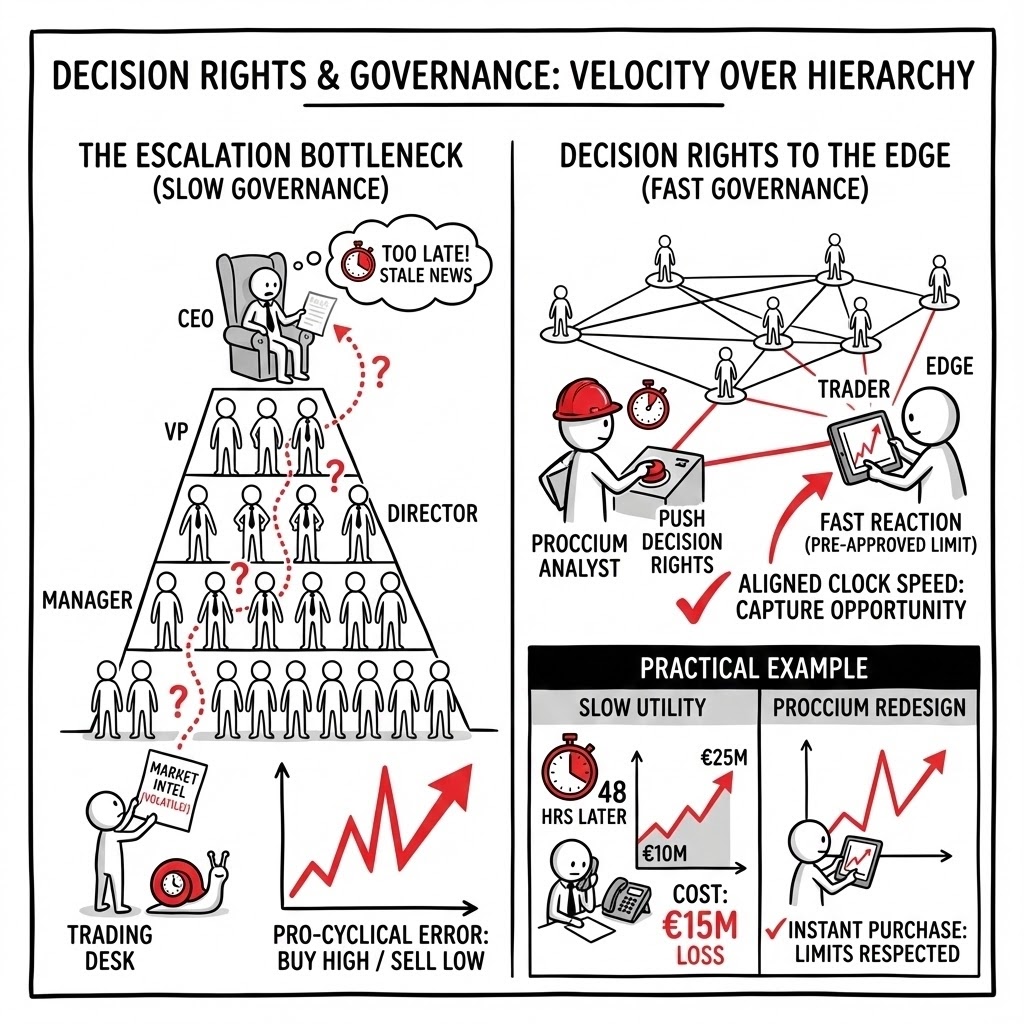

Decision Rights & Governance. We redesign organizational charts not based on hierarchy, but on decision velocity. Who has the authority to allocate capital? How fast can the organization react to a price shock? We align the internal "clock speed" of the firm with the volatility of the external market.

The Strategic Imperative: Market volatility does not wait for the Steering Committee meeting next Tuesday. We map the "Decision Latency" of your firm. If the market moves 5% in an hour, but your approval process takes 5 days, you are structurally short volatility. We push decision rights to the edge, governed by strict limits, not bureaucratic permission.

The Failure Mode: "The Escalation Bottleneck." Information travels up the chain slowly, getting diluted at every step. By the time the CEO sees the data, it is a lag indicator, not a lead indicator. The decision is made on stale news, leading to pro-cyclical errors (buying at the top, selling at the bottom).

Practical Example: A utility company required Board approval for any gas purchase over €10M. During the 2022 energy crisis, prices spiked so fast that a standard cargo breached this limit. The trading desk waited 48 hours for an emergency Board vote. In that time, the price rose another €15M—a direct cost of slow governance.

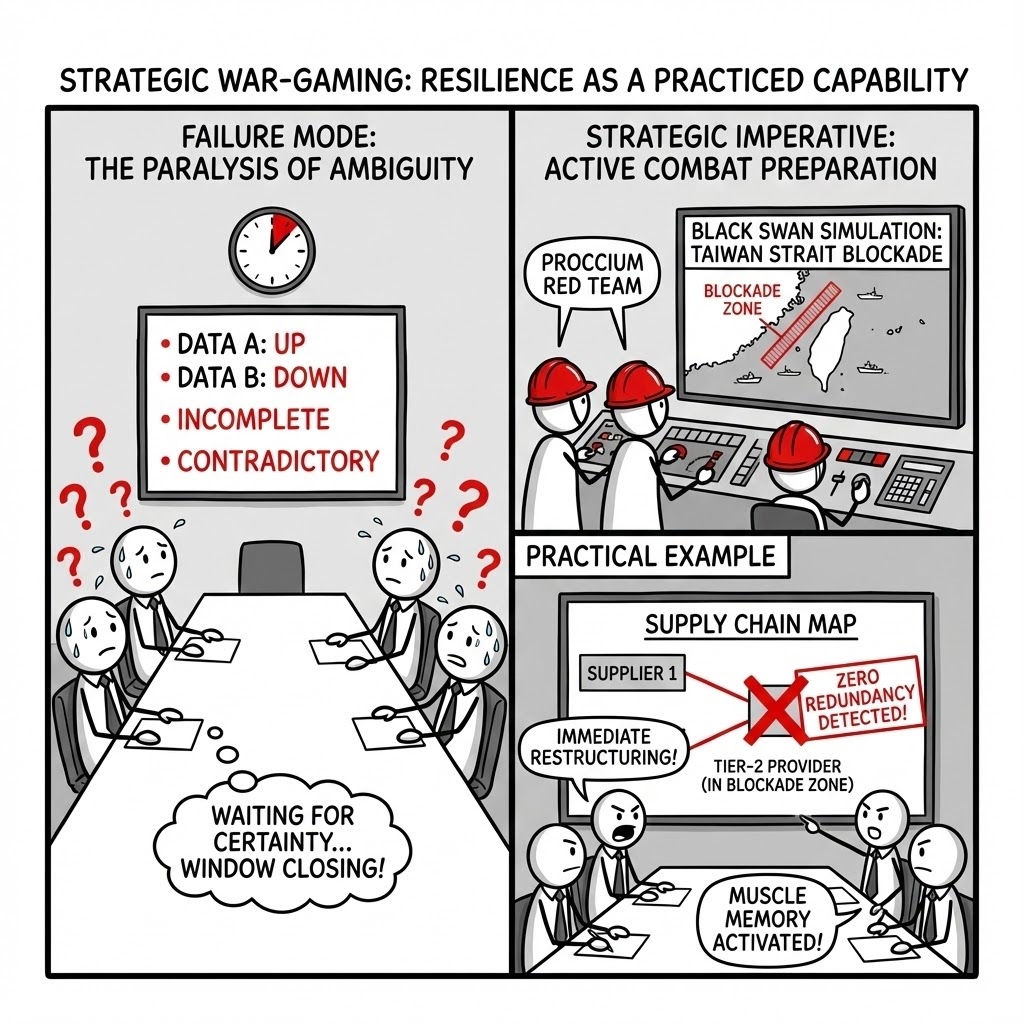

Strategic War-Gaming. Resilience is not a theoretical state; it is a practiced capability. We run "Red Team" simulations—forcing your executive team to respond to simulated crises (e.g., a competitor breakthrough, a supply chain embargo). We identify the institutional bottlenecks that would cause paralysis in a real crisis.

The Strategic Imperative: You do not test the fire escape when the building is burning. We treat strategy as active combat preparation. We simulate "Black Swan" events to test the human element: communication lines, emotional resilience, and information flow. This builds the muscle memory required to act decisively when competitors are panicking.

The Failure Mode: "The Paralysis of Ambiguity." In a real crisis, data is contradictory and incomplete. Executives trained on perfect quarterly reports often freeze, waiting for "better data" that will never come. While they wait for certainty, the window of opportunity closes.

Practical Example: We simulated a "Taiwan Strait Blockade" scenario for a global electronics manufacturer. The simulation revealed that their "dual-source" strategy was flawed: both suppliers relied on the same Tier-2 provider in the blockade zone. They realized they had zero redundancy, prompting an immediate supply chain restructuring.

Distinct Value: Strategy vs. Project Development

To clarify how Proccium engages, we distinguish between Architecting the Firm and De-Risking the Project.

| Practice Area | The Core Question | The Deliverable | |

|---|---|---|---|

| Industrial Strategy | "Do we have the right portfolio of assets to survive the next decade?" | A Portfolio Transition Roadmap, Divestiture Plan, and Capital Allocation Logic. | |

| Strategic Project Development | "Is this specific investment robust and bankable?" | A De-Risked Feasibility Study, Financial Model, and Investment Memo. | |

Perspective

The purpose of strategy is not to eliminate risk, but to take the right risks with full awareness. It is the discipline of creating a business that can not only endure the future but capitalise on it.

We bring the “Outside-In” perspective—unencumbered by internal politics or historical bias—to help you build an enterprise that is fit for the reality of tomorrow.

The conversation begins here. office@proccium-com · +43 664 454 21 20