Valuation :: The Calculus of Industrial Reality

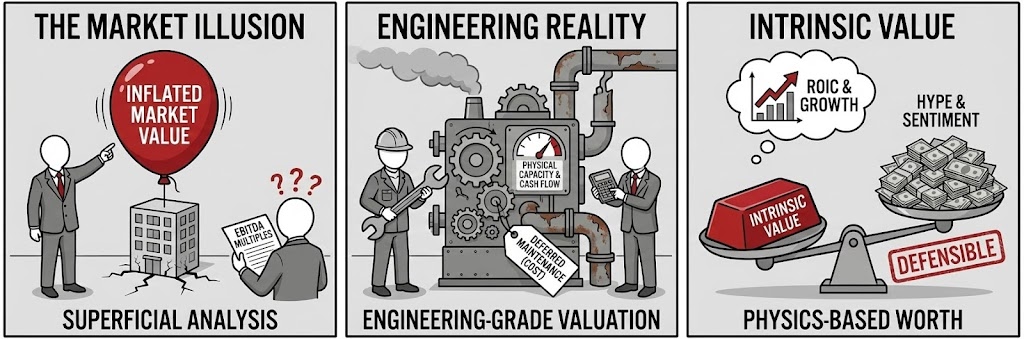

In capital-intensive sectors, value is not a matter of market sentiment; it is a derivative of physical capacity, thermodynamic limits, and cash-generation physics. We do not offer “fairness opinions” based on loose industry multiples. We provide Engineering-Grade Valuation.

At Proccium, we bridge the gap between the Technical Reality of the asset (mass balances, maintenance states, obsolescence) and the Financial Requirements of the boardroom. We strip away the accounting distortions to reveal the Intrinsic Value—the present value of the future cash flows that the asset can actually physically deliver.

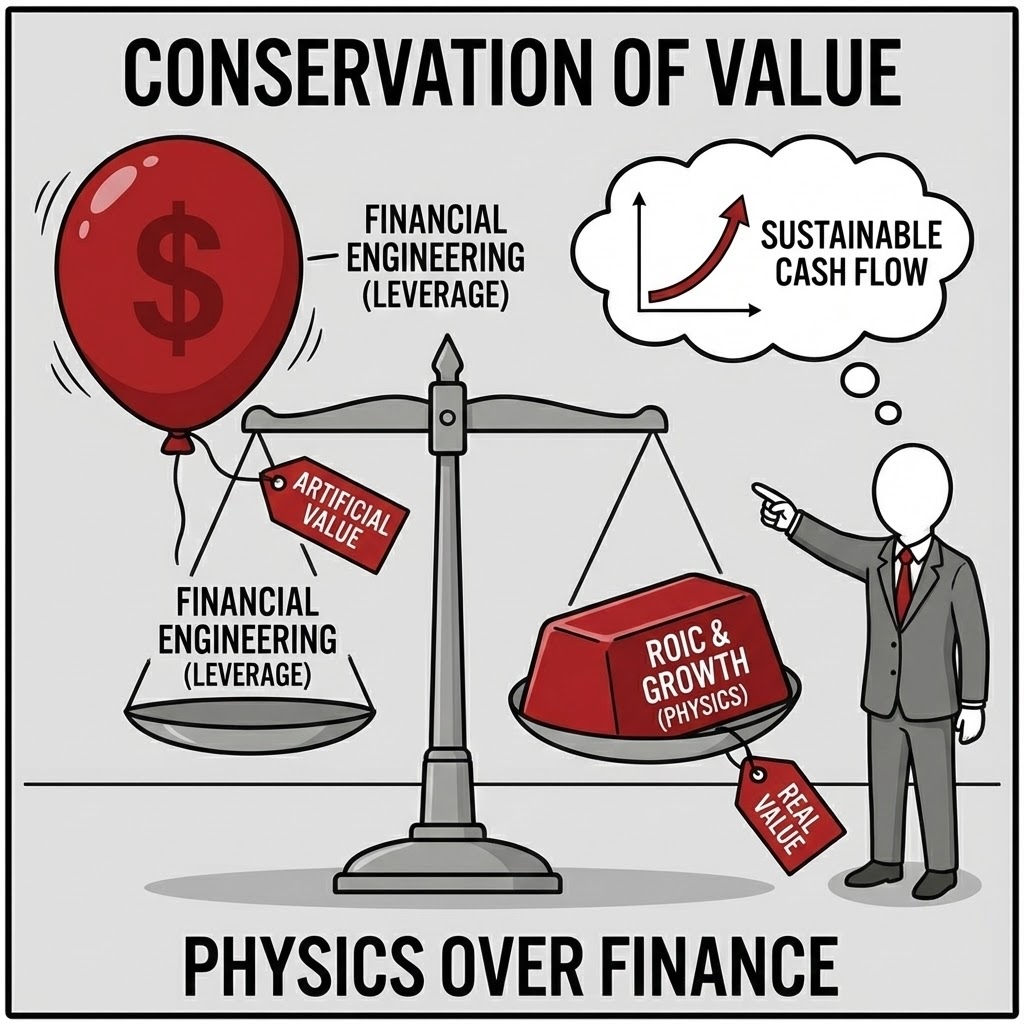

The Conservation of Value

We adhere to a strict First Principles approach: Value is created only by Return on Invested Capital (ROIC) and Growth. Financial engineering (leverage) does not create value; it merely transfers risk.

Physics over Finance. Standard valuation often relies on "EBITDA Multiples" or "Comparable Transactions." For unique, distressed, or complex industrial assets, there are no comparables. We reject these shortcuts. We build "Bottom-Up" valuations derived from the asset’s engineering fundamentals, ensuring the price reflects the true economic profit, not just a temporary market cycle.

Our valuation practice is designed for "Special Situations"—contexts where standard accounting methodologies fail to capture the true risk or opportunity:

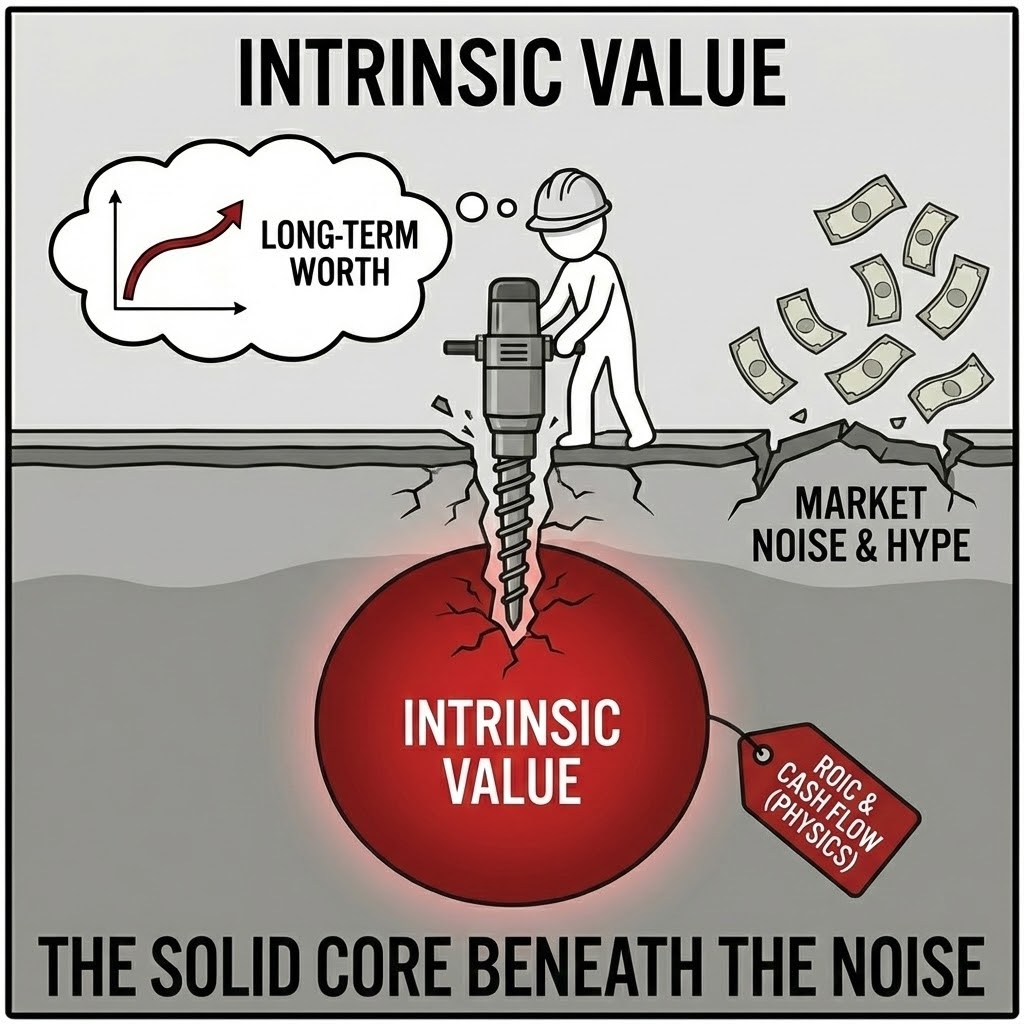

Intrinsic Value vs. Market Pricing. The market price is what you pay; intrinsic value is what you get. We rigorously separate the two. We calculate value based on long-term cash generation capability, stripping out "Market Heat," "Synergy Hype," and temporary commodity spikes.

The Strategic Imperative: In cyclical industries, market pricing is often manic-depressive. Assets are vastly overpriced at the peak and undervalued at the trough. We provide the "Through-Cycle" valuation anchor. We tell you what the asset is worth based on its fundamental economics, giving you the confidence to buy when the market is panic-selling and sell when the market is euphoric.

The Failure Mode: "The Multiple Trap." Valuing a refinery at "6x EBITDA" because that is the industry average is fatal if the specific refinery has deferred maintenance liabilities that will wipe out cash flow for three years. Multiples hide the rust; we expose it.

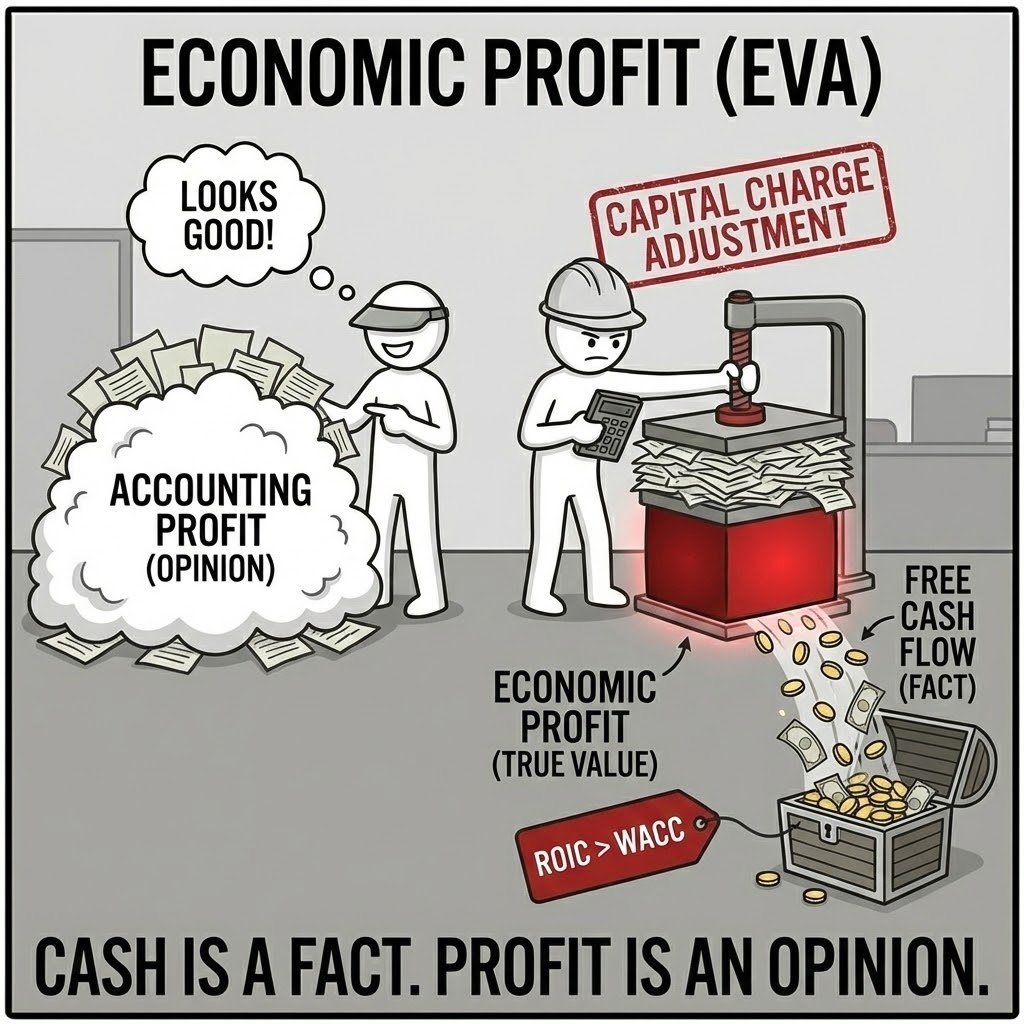

Economic Profit (EVA) Focus. Accounting profit is an opinion; cash is a fact. We focus relentlessly on Free Cash Flow (FCF) and ROIC. We adjust reported earnings to reflect the true capital charge of the assets employed.

The Strategic Imperative: Growth destroys value if ROIC is lower than the Cost of Capital (WACC). Many industrial conglomerates grow "earnings" while destroying shareholder value because the capital required to generate those earnings is too expensive. We decompose the business to identify which specific units are "Value Creators" (ROIC > WACC) and which are "Value Destroyers" (ROIC < WACC).

The Failure Mode: "The Growth Illusion." Management celebrates a 10% revenue increase. But if achieving that growth required a 20% increase in Working Capital and CAPEX, the firm is actually bleeding economic value. We expose this "Empty Calorie" growth.

Service Architecture: Engineering-Grade Valuation

We operate where standard audit firms cannot: deep inside the technical and operational complexity of the asset.

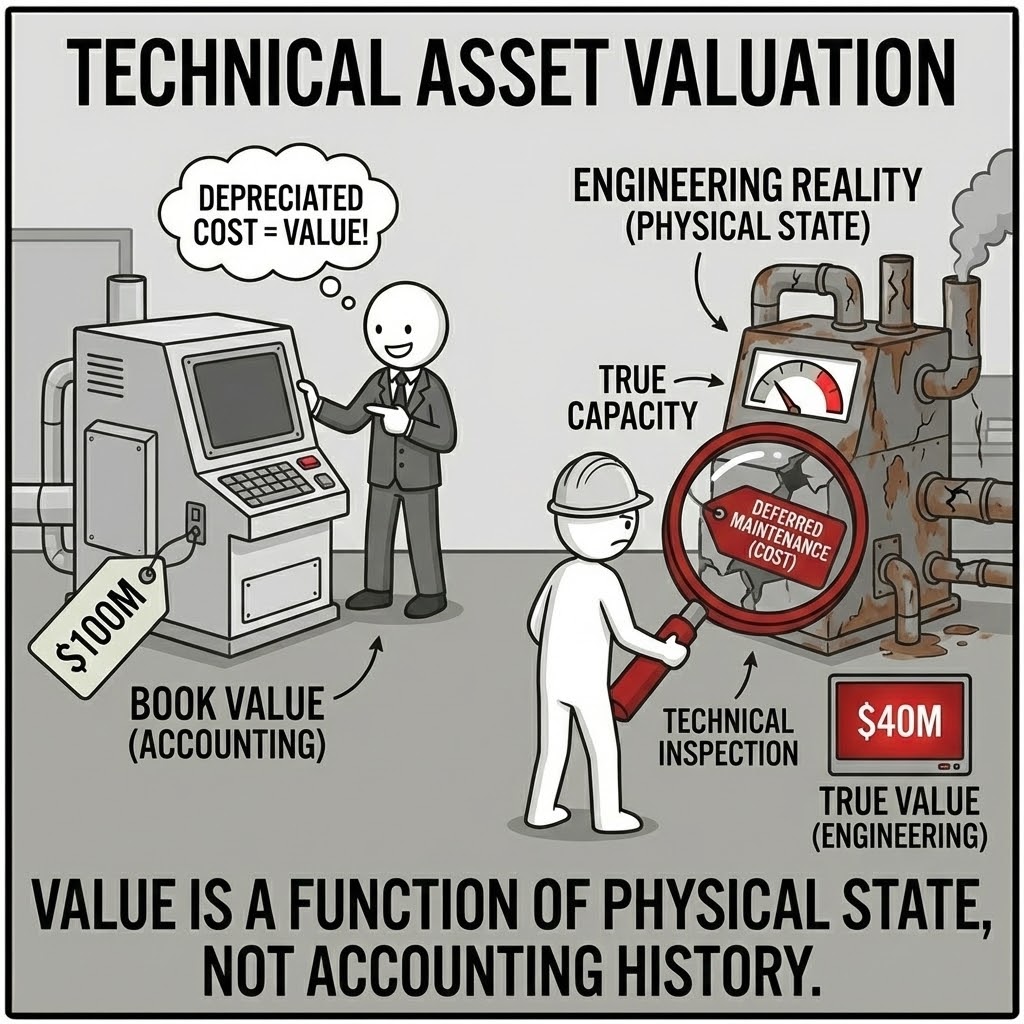

1. Technical Asset Valuation. A "Nameplate Capacity" of 100k tonnes is worthless if the cooling system limits it to 80k. We adjust the financial model to reflect the engineering reality, incorporating the "Cost to Cure" deferred maintenance directly into the enterprise value.

The Strategic Imperative: In heavy industry, the Balance Sheet often lies. Assets are held at "Book Value" (Historical Cost minus Depreciation) which bears no relation to their actual productive capacity. We re-value the asset based on its current physical state. We quantify the impact of corrosion, obsolescence, and bottlenecks, often revealing that a "cheap" acquisition is actually a liability.

The Failure Mode: "The Lemon Market." A buyer relies on the seller's "Adjusted EBITDA" and standard depreciation schedules. Post-close, they discover the boiler needs total replacement. The deal model breaks immediately. We prevent this by treating valuation as an engineering exercise first, and a financial exercise second.

Practical Example: A client looked at a chemical plant valued at $200M based on 10x EBITDA. Our technical valuation revealed that the control system was obsolete and no longer supported by the vendor, requiring a $40M upgrade in Year 1. We adjusted the valuation to $160M, and the seller accepted the chip.

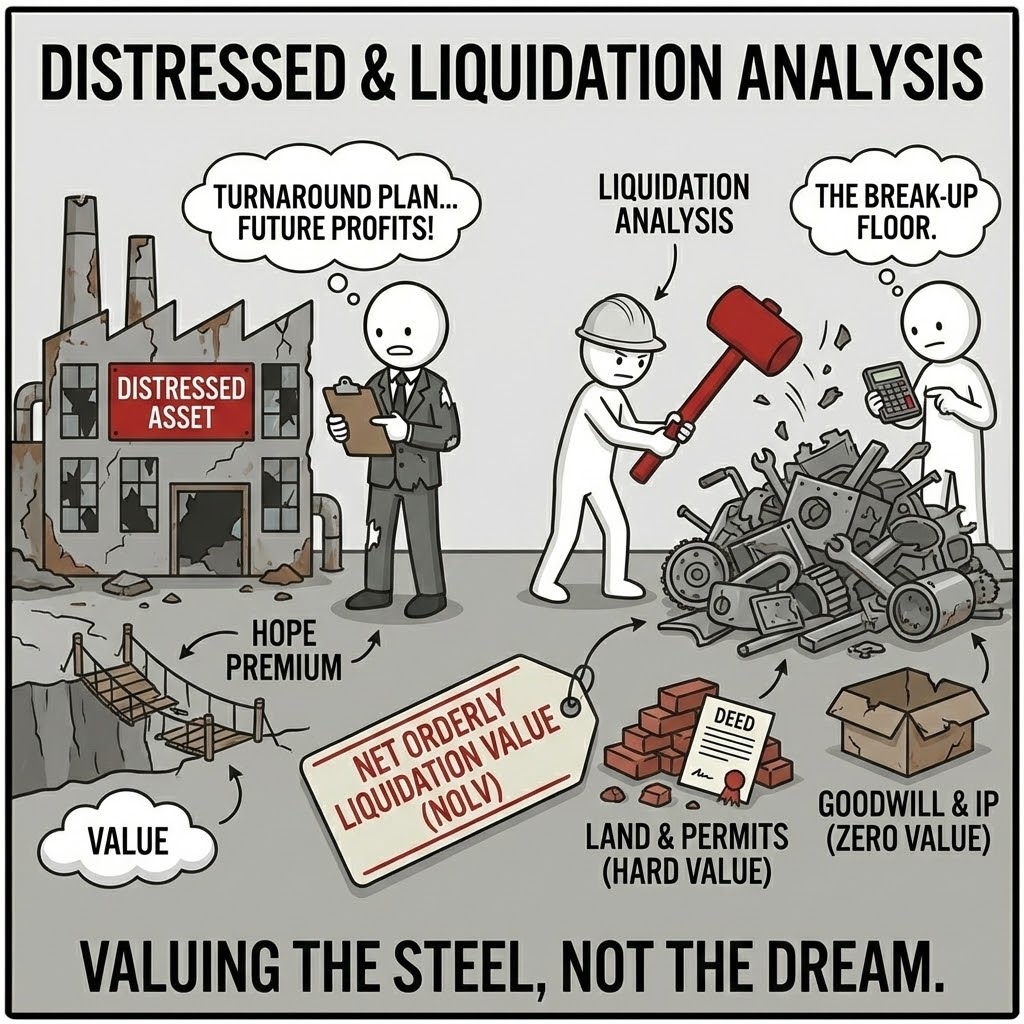

2. Distressed & Liquidation Analysis. In distress, "Going Concern" value evaporates. We calculate the hard floor: the **Net Orderly Liquidation Value (NOLV)**. We distinguish between the value of the business and the value of the steel.

The Strategic Imperative: Creditors need to know the worst-case scenario. We provide the "Break-Up Value" of the complex. If the sum of the parts (land, permits, scrap steel, inventory) exceeds the enterprise value, the rational strategy is liquidation, not restructuring. We provide the cold, hard math to support that difficult decision.

The Failure Mode: "Hope Premium." Distressed companies often inflate their balance sheets with "Goodwill," "Deferred Tax Assets," and "IP." In a liquidation, these are worth zero. We strip them out mercilessly. We value the assets based on what a scavenger would pay in 90 days, providing the brutal certainty required for debt restructuring negotiations.

Practical Example: A steel mill in administration claimed a value of $50M based on future cash flows. Our NOLV analysis showed the scrap value of the machinery plus the land was $65M. The creditors forced a liquidation, recovering 30% more capital than the "turnaround" plan offered.

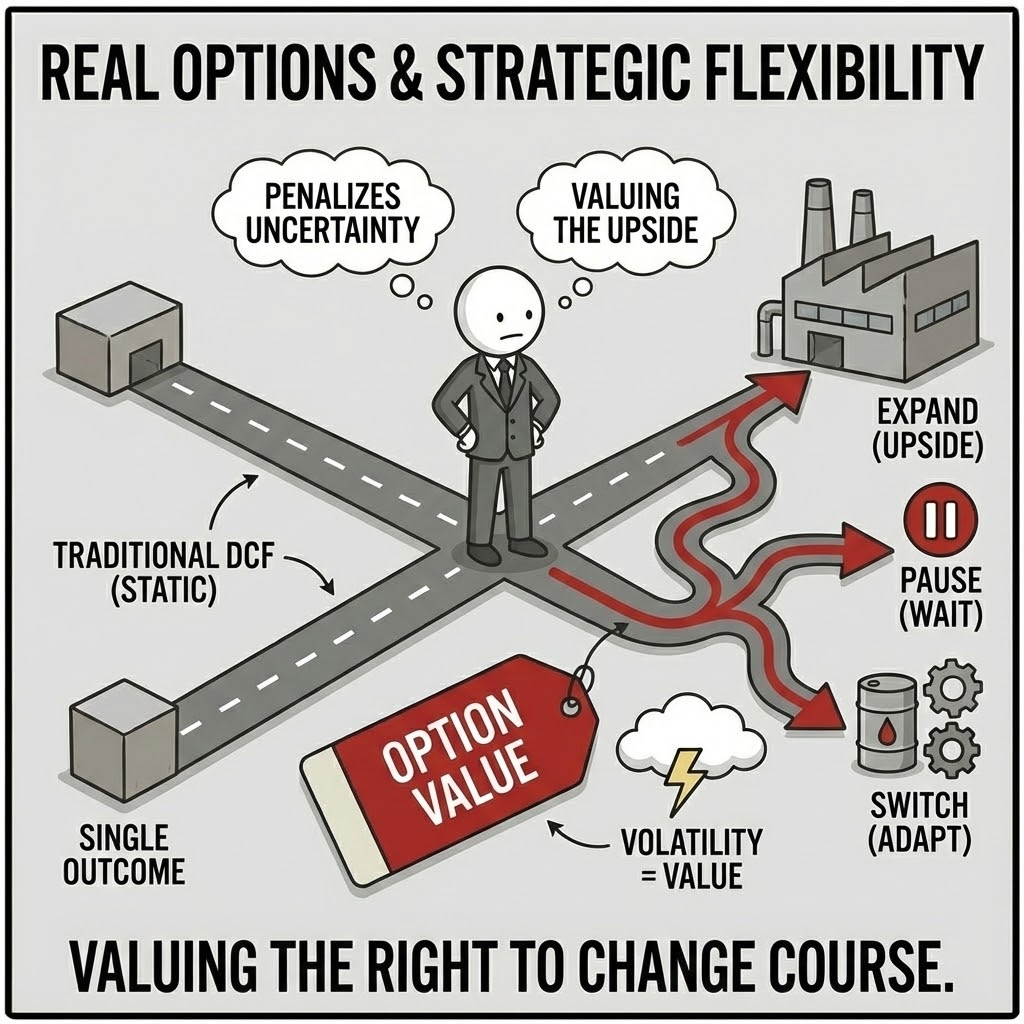

3. Real Options & Strategic Flexibility. Traditional DCF penalizes uncertainty and undervalues flexibility. We use **Real Options Analysis (ROA)** to value the upside of volatility. We quantify the "Right to Expand," "Right to Pause," and "Right to Switch Fuels."

The Strategic Imperative: A flexible plant is worth more than a rigid one, even if their cash flows are identical today. We mathematically quantify this "Flexibility Premium." This often allows highly innovative, modular projects to pass investment hurdles that they would fail under standard static analysis.

The Failure Mode: "The NPV Trap." A modular project might look expensive on a static NPV basis. But if it allows you to stop spending during a downturn, that "Option to Abandon" has immense value. Standard finance treats this flexibility as zero; we bring this hidden value onto the balance sheet.

Practical Example: An energy developer was choosing between a large Monolith plant (NPV $100M) and a Modular build (NPV $80M). Our Real Options analysis showed the Modular approach had an "Option Value" of $40M because it allowed them to cancel Phase 2 if prices dropped. Total Value: $120M. They chose the modular path.

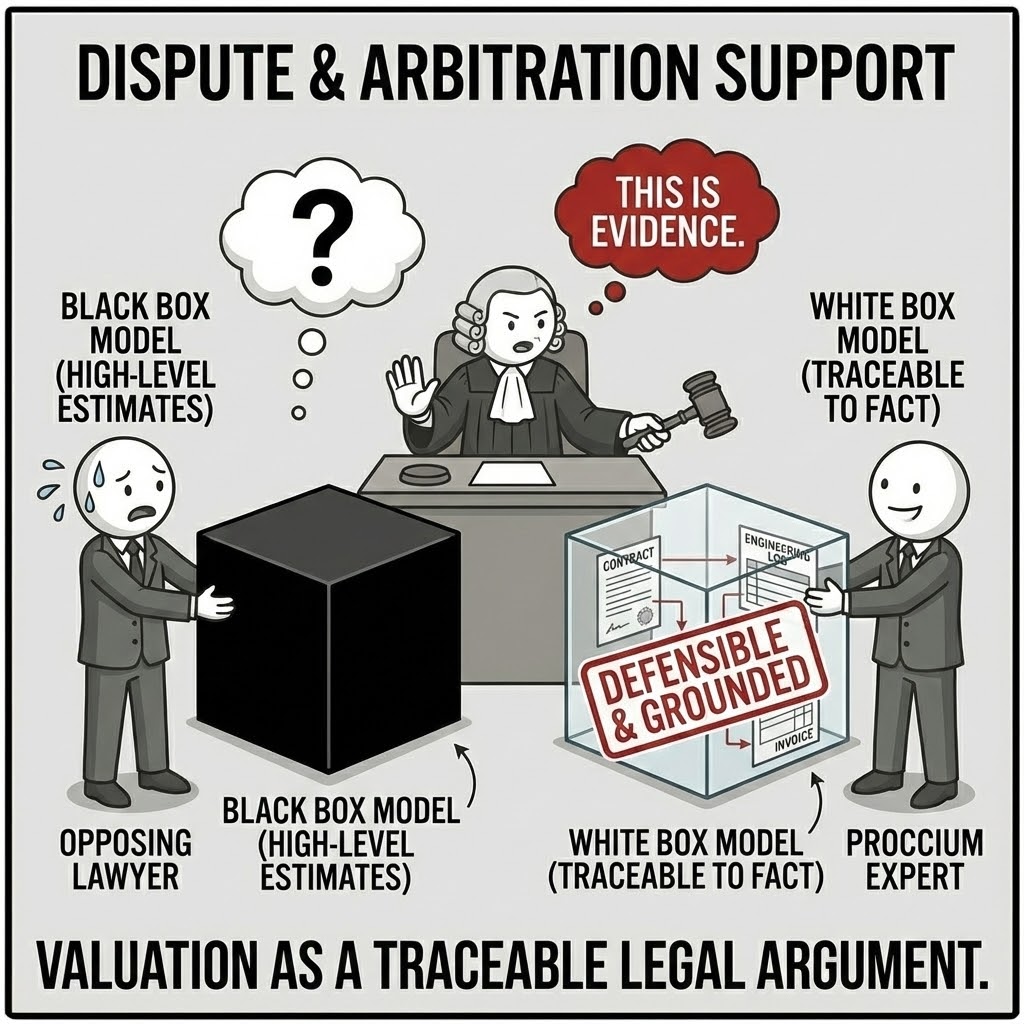

4. Dispute & Arbitration Support. When joint ventures dissolve or contracts are breached, value becomes a legal argument. We provide the Independent Expert Report—defensible, traceable, and grounded in industrial fact—to settle the number.

The Strategic Imperative: In arbitration, the side with the most rigorous model usually wins. We do not produce "black box" numbers. We produce "White Box" models where every assumption is traced to a contract clause, engineering log, or invoice. We prepare the expert witness to defend the valuation under cross-examination, dismantling the opposing side's "high-level" estimates.

The Failure Mode: "The House of Cards." A valuation based on "Management Projections" falls apart in court when the opposition asks for the engineering basis of the projections. If you cannot prove the volume assumption with a mass balance, you lose the argument.

Distinct Value: The Proccium Valuation Standard

We define valuation not as an administrative task, but as a rigorous stress-test of the business model.

| Methodology | The Standard Approach | The Proccium Approach | |

|---|---|---|---|

| Comparables | "Industry average is 8x EBITDA." | "This specific asset's remaining useful life and thermodynamic efficiency justify 5.4x." |

| Terminal Value | Perpetual growth rate (g) of 2%. | NOLV (Net Orderly Liquidation Value) or Decommissioning Liability assessment. |

| Risk Adjustments | Arbitrary WACC premium (+2%). | Explicit Cash Flow Scenarios (Monte Carlo) modeling the specific risk events. |

The conversation begins here. office@proccium-com · +43 664 454 21 20